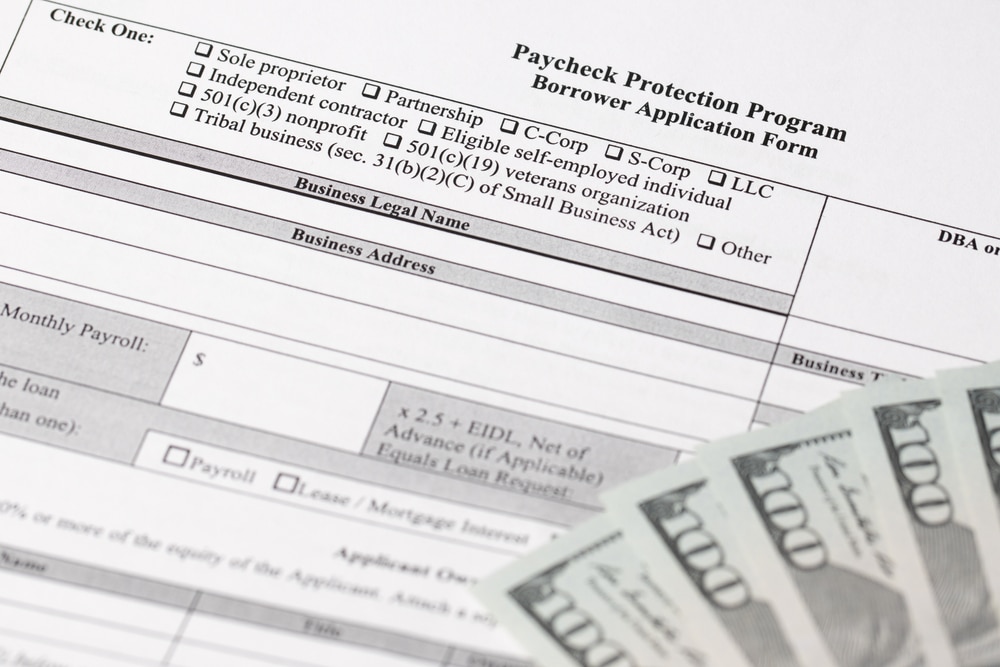

But luckily, just before we rang in 2021, Congress passed a new stimulus bill into law, providing much-needed assistance to small businesses and self-employed individuals. This stimulus package re-funds the Paycheck Protection Program (PPP) and can be a major game changer for your home service business, especially if you have been hit hard by the economic repercussions of COVID-19.

While the practical specifics have yet to be finalized by the Small Business Administration (SBA), we wanted to provide you with some of the basic information so that you can be better prepared to lead your home service business through 2021 and beyond.

Hold up: What’s in the Stimulus Bill anyway?

The recently passed bill, which allocates $325 billion in small business funds, includes a number of provisions, but we’ll focus on the ones that can be most relevant to your service business:

- PPP Round 2: The bill renews the Paycheck Protection Program (PPP) with an infusion of $284.5 billion, allowing small businesses like yours to apply for the potentially fully forgivable loans included in this program.

- PPP Tax-Deductibility: The new bill reclassifies PPP-covered expenses as tax-deductible, meaning that past recipients of PPP loans can now deduct expenses covered by loan funds.

- EIDL Expansion: The bill earmarks additional funding to the Economic Injury Disaster Loan (EIDL) program in low-income neighborhoods. If you run a business in a low-income community, you can now get $10,000 in EIDL/Advance grants (or the remaining amount up to $10,000 if you received a partial grant in the past).

What is a PPP loan, and why is it important for your home service business now?

The PPP was first introduced in March 2020 to directly incentivize small business owners to keep workers employed. This was done by providing relief in the form of forgivable loans to businesses that met the requirements for employee retention and used the proceeds of the loans for applicable expenses. The loans could cover up to 2.5 times a business’s monthly payroll, and funds had to be spent within a certain time frame on qualified expenses, namely payroll.

Funds from the first round ran out earlier this year, but as of last week, the program has been re-funded, which could be great news for your home service business. Although there are size and time restrictions, if your business is a corporation or an LLC or you are a sole proprietor, self-employed individual, or independent contractor, you may be eligible to apply for a loan of up to $2 million.

It’s important to note that you can apply for a PPP loan for your home service business:

- Even if you didn’t apply in the first round.

- If you did receive an initial PPP loan and want a second draw loan.

- If you returned your first loan or did not take the full balance for which you were eligible.

How Do I Know If My Service Business is Eligible for PPP?

You can apply for a PPP loan if you can demonstrate that:

- Gross revenue has dipped at least 25% in any quarter of 2020 (in comparison to the previous year).

- Your business has existed prior to February 15, 2020, and employs fewer than 300 employees.

- You have spent or will spend prior PPP funds (for second-time applicants).

How can I use my PPP funds?

The PPP loan is conditional and must be spent within a specific amount of time in order to qualify for forgiveness, so it’s important to understand and plan what you’ll use the funds for. If your home service business is eligible for a PPP loan, you can use the proceeds to cover a number of expenses, such as:

- Payroll expenses, including salaries/wages, commissions, and other compensations (with a cap), cash tips, vacation and various types of leaves, dismissal/separation, employee benefits, retirement benefits, and state and local taxes on employee compensation. You can also now use your PPP loan to pay for group health insurance benefits (including life, disability, vision, and dental).

If you’ve let employees (technicians, office staff, etc.) go this year because of cutbacks, the PPP funds can help you bring those workers back. Be strategic about personnel decisions and consider bringing back employees that will really help you sustain and grow your home service business through the pandemic and beyond.

While the payroll expenses are nothing new, and at least 60% of a business’s PPP loan must be used on these, Round 2 of the PPP includes an expanded list of expenses for which funds can be used (and still be eligible for loan forgiveness). These include:

- Operations: You can now use the funds from your loan to cover certain operations expenses (software, human resources, cloud computing, and accounting). If you’re using a field service management software, accounting system, or payroll platform to run your business, you could be using PPP funds to pay for these, with possible tax deduction opportunities to top that.

- Property damage: If your home service business (brick-and-mortar location, vehicles, etc.) experienced damage as a result of public disturbances that took place in 2020, you could use your PPP funds to cover any property damage costs.

- Supplier costs: If you ordered essential supplies or other goods (or even committed to ordering via a contract or purchase order) before receiving a PPP loan, you could now use PPP funds to cover those costs. Using a field service management software that tracks inventory and usage can also help you stay on top of your orders and supplies, as accurate record-keeping is essential for the PPP application process.

- Protective equipment costs: If you acquired or need to acquire personal protective equipment for your technicians and employees or make other investments to accommodate federal, state, or local COVID-19 guidelines, you can use your PPP funds to cover these expenses. (Small plug: if you are using a field service business management software, you can also keep your techs safe with features like live video estimates that can limit the amount of contact they have with clients).

If you are eligible for PPP funds, consider consulting an accountant who can discuss the possible tax deductions for your home service business as well. To make the most out of your PPP money—and ensure your home service business is in compliance with the rules governing this program, make sure you carefully document all expenses covered with the PPP loan funds.

Preparing for PPP

During the previous round of PPP loans, small businesses learned the hard way that funds were limited. Those who waited and didn’t apply right away missed out.

The good news is that the funding has been expanded and the program adjusted to target smaller businesses (with a lower employee count threshold and reduced maximum loan amount, greater incentives for lenders to give smaller loans to smaller companies, and an easier forgiveness application process for borrowers with smaller loans).

The not (so) good news for service businesses is that eligibility has been broadened to include more kinds of businesses, which could heighten competition in the playing field. For this reason, if your service business is eligible for a loan under the PPP, it’s imperative that you apply as soon as the guidelines are released by the SBA (which could be any day now).

Here are a few guidelines to check if you are eligible for the new PPP funding:

-

- Reflect on your revenue: Did your home service business experience a 25% or greater gross revenue decline in any quarter of 2020 (as compared to 2019)? Make sure your business records are in tip-top shape in time for the inauguration of this new round of funding so you can move right when applications officially open. (More information on how to calculate the revenue reduction here).

- Brace for borrowing: Get in touch with your local lending institutions (these could be banks, credit unions, FinTech companies, community lenders, etc.) to get the low down on their participation in this new round. During the last round, there was some confusion about participation and eligibility from the financial institutions’ end. Ask if you need to be an existing customer to receive a PPP loan from a particular institution, and plan accordingly. Get personal with these institutions, and build a rapport with a loan officer, so that when it comes time to apply for a PPP loan, you will be a familiar face standing out among a sea of eager applicants. If you don’t have a business banking account, you’ll need to add that to your priorities so that you can be prepared to receive a PPP loan, if approved. Opening a sub-account for the loan proceeds can also help your business stay organized and track and document the disbursal of these funds.

- Map your money: Have a plan for how you intend to spend your PPP loan funds if you are deemed eligible. Consider whether you can comply with the conditions necessary for forgiveness, or if you prefer instead to spend the funds on non-qualifying expenses and pay the loan back at the 1% interest rate.

- Apply ASAP: If you remain alert and attentive to the process and come prepared, you should be able to apply for a PPP loan for your service business on opening day. Most importantly, don’t let this opportunity for crucial assistance pass you by. Here is the application so you can start preparing the information you will need to apply. Read more to see if you are eligible to apply using a more simplified form (for loans under $150K). Note that once the applications open, the deadline to apply is March 31, 2021.

Takeaway

The announcement of the PPP renewal is big news! If your home service business suffered during the COVID-19 pandemic and is eligible to apply for a loan, it could provide necessary funds to sustain and grow your business for the future. Although the application process can be lengthy, tedious, and confusing, it may pay off in the long run and help you get your business back on track after a challenging year.