1. Check your balance sheets against your reports

Balance sheets are a useful tool and they can make your life easier if you utilize them correctly. Every number on your balance sheet can be tied to a report, so if there’s a discrepancy, you can easily cross-check it against the relevant report. This will give you a snapshot of where your business is and help you understand your cash flow at any given time.

2. Know where to look for the common causes of inaccuracies

Instead of looking for the proverbial needle in the haystack, focus on the most common causes of inaccurate books. These include mismatched bank deposits and invoice payments, and mismatched reports from the invoicing system. These inaccuracies are especially common when using an invoicing system without a connected payment solution.

So, if you aren’t using a connected payment system yet, you might want to consider implementing one in the coming year.

3. Do your tax prep

Every business needs to meet a variety of tax requirements—both general requirements and ones that are specific to the business. To make sure you meet all of the requirements, review your documentation ahead of time to make sure everything—including your financial statements, account statements, PR summary, asset list, notes, and IRS documents—are in order.

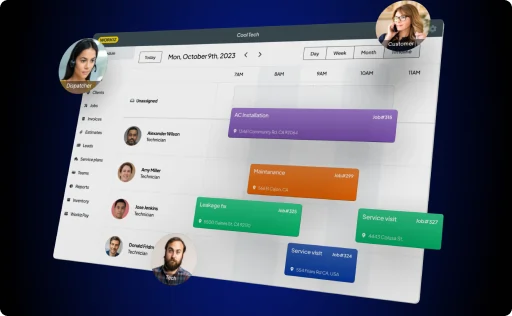

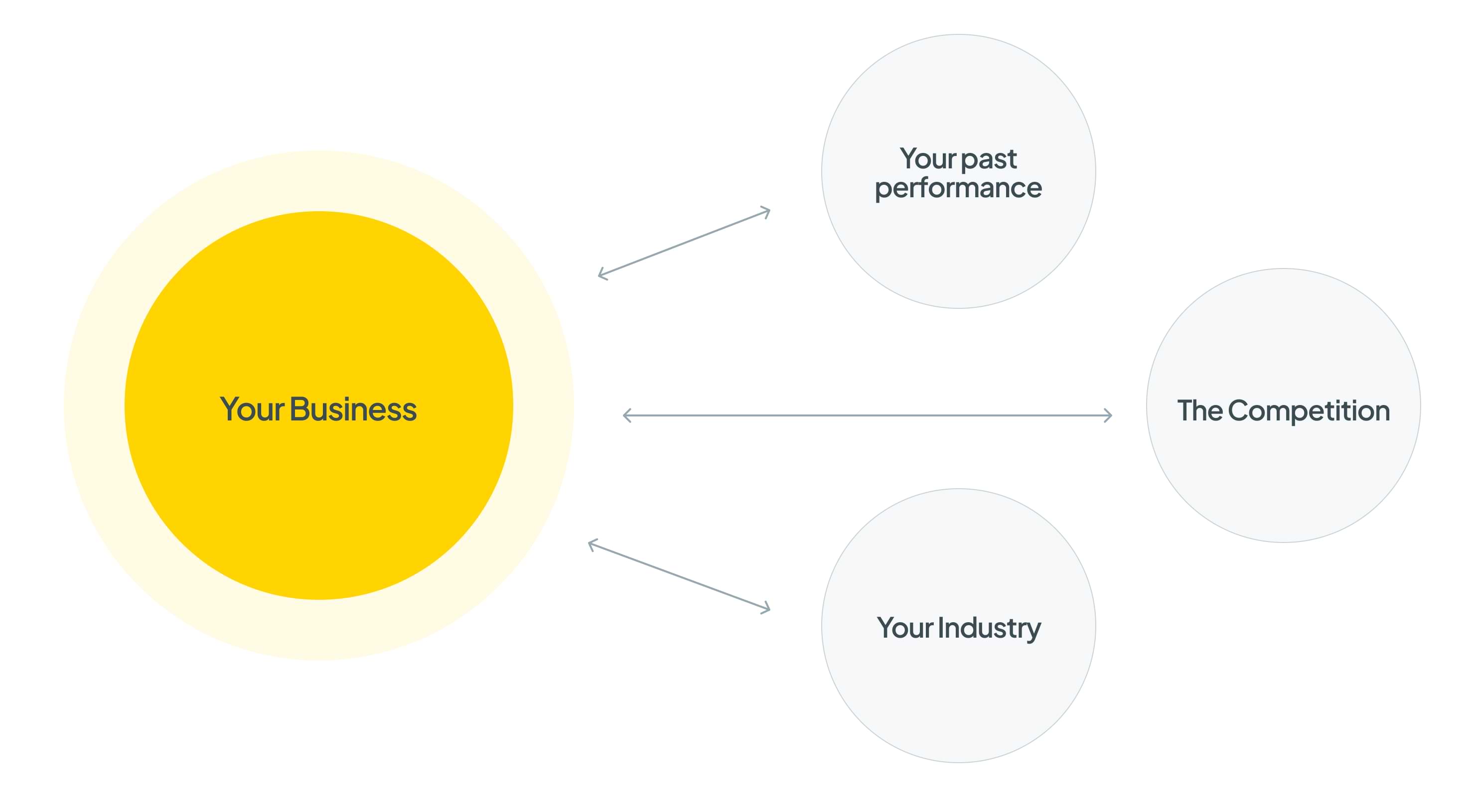

4. Leverage the books for growth

Financial reporting isn’t only a bureaucratic headache—diving into your financial ratios can help you better understand your business health. As you balance the books, take the time to measure your performance in comparison to your own business in past years, your competition, and your industry as a whole.

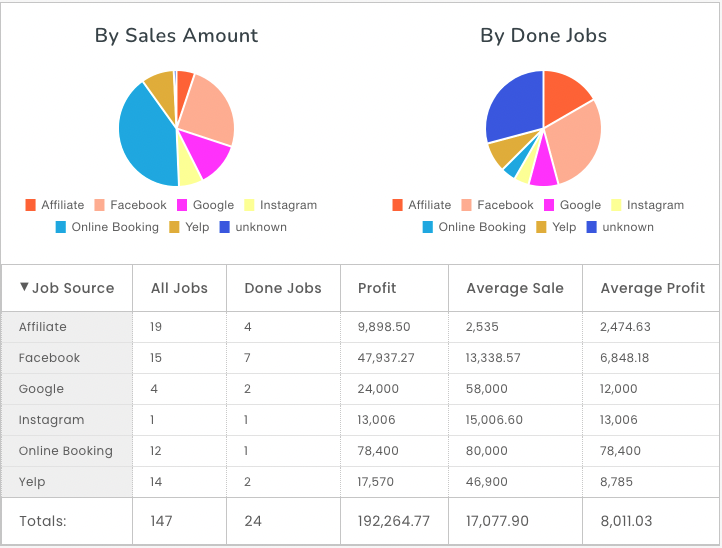

5. Check how much you spend on advertising

You know where you’re advertising and how much it costs. But do you know the return you got on your investment? If not, it’s important to figure it out so you can make smarter advertising decisions in the coming year.

Start by dividing your overall advertising expense by your revenue. Having a report will show you how many jobs were actually closed from each advertising source, so you can figure out how much value you gained from that source.

Here’s how it looks on the Workiz ROI per Ad spend report

For more information on reports and analytics click here

See—that wasn’t so scary. Following these simple tips can help you make sure that your books are in order and you’re ready to head into the new year on the right foot.