So, for field service companies, clear and efficient invoicing is necessary for maintaining healthy cash flow and fostering positive client relationships. A well-designed invoice ensures you get paid for the valuable work you do, while also providing transparency and clarity to your customers. In the United States, businesses process an average of 500 invoices monthly, with nearly half (48%) handling up to 500.

This comprehensive guide dives deep into the world of field service invoicing, equipping you with the knowledge and tools to create invoice that streamline billing and expedite payments.

The importance of invoicing in the field service industry

Let’s face it, in the field service world, things can get hectic. Techs are zipping from job to job, fixing leaky faucets and faulty furnaces. But hold on, amidst the whirlwind of service calls, there’s one key element that often gets overlooked: the invoice.

What is invoice?

An invoice, also referred to as a bill or tab, is a document issued by a seller to a buyer after a sale or service has been completed. It acts as a formal record of the transaction and details what was purchased, the quantity, agreed-upon prices, and the total amount owed.

Think of an invoice as the engine that keeps your cash flow chugging along. You don’t just have to look at it as a bill but also as a clear and transparent record that ensures you get paid for the awesome work your technicians do. A study by National Federation of Independent Business found that 52% of UK small business owners worry about unpaid invoices, emphasizing the importance of efficient invoicing for maintaining cash flow.

So, why is invoicing such a big deal for field service businesses? Let’s break it down in a way that’s easier to swallow than a clogged drain.

Invoice and payment volumes

Provides a cash flow lifeline

For any business, but especially for field service companies where projects are completed on-site, a steady stream of income is vital. Delayed or missed payments can create a cash flow crisis, hindering your ability to pay employees, invest in equipment, and fuel future growth.

Accurate and timely invoices, sent promptly after service completion, encourage faster payments from clients. Think of them as friendly reminders that ensure you get paid for the valuable work your technicians perform.

Helps build trust

A well-structured invoice fosters trust between you and your clients. By providing a detailed breakdown of labor hours, materials used, and any additional charges, your clients have a clear picture of what they’re paying for. This transparency eliminates confusion and fosters a sense of fairness, strengthening your client relationships and promoting repeat business.

Accuracy is key

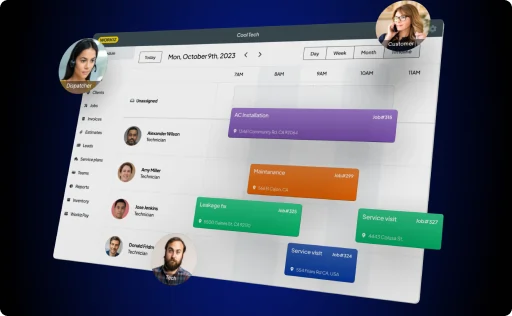

Manual invoicing processes are prone to errors, leading to over-billing or under-billing, both of which can damage client relationships and impact profitability. Imagine accidentally overcharging a customer – not exactly a recipe for a happy client! Investing in field service management (FSM) software and invoice app can be a game-changer.

These tools automate many aspects of the invoicing process, minimizing human error and ensuring your invoices are accurate reflections of the services rendered.

More time for what matters

Creating invoices manually and chasing down payments can be a significant time drain for your administrative staff. By automating invoicing and offering online payment options, you free up valuable time for your team to focus on core business activities like scheduling appointments, dispatching technicians, and providing exceptional customer service.

Think of it as a productivity superpower, allowing your team to do what they do best – serve your clients effectively.

Data-driven decisions for future growth

Detailed invoices are valuable repositories of data, offering insights into service costs, material usage, and technician productivity. Analyzing this data can empower you to make informed decisions about your business.

For example, you might identify areas where costs can be optimized, adjust your pricing strategies to maximize profitability, or allocate resources more effectively based on technician strengths. This data-driven approach positions you for sustainable growth and helps you stay ahead of the competition.

Key elements to include in your field service company invoice

Creating a comprehensive and simple invoice is very important for several reasons. Not only does it serve as a formal request for payment, but it also acts as a record of services provided, pricing details, and terms of agreement.

We’ve talked about how a detailed invoice helps maintain transparency between the service provider and the client, minimizes disputes, and ensures timely payment. To achieve these objectives, certain key elements should be included in the invoice. Here are some necessary details that will help on how to write an invoice:

Company information and logo

At the top of the invoice, it’s important to include the company’s name, address, contact information, and logo. If you check out invoice examples from top companies, you will notice these tiny details.

It establishes brand identity and exudes a sense of professionalism. Clients should have no difficulty identifying the source of the invoice, which promotes trust and credibility.

Client information

Equally important is the inclusion of client details such as name, address, contact information, and any relevant account or reference numbers. You cannot create an invoice without including these details. Attaching this client information shows that the invoice is directed to the correct recipient and facilitates easy communication between the client and the service provider.

Invoice number and date

Every invoice should have a unique identification number for tracking and reference purposes. Additionally, it should include the date of issuance to establish the timeline for payment and serve as a point of reference for both parties.

You should also clearly state the date by which payment is expected. Consider using standard payment terms like “net 30” (payment due within 30 days) or “net 15” (payment due within 15 days) to set clear expectations.

Description of services

Another information you need to know on how to write an invoice, you must clearly outline the services provided, including a brief description of each service, quantity, and any applicable rates or pricing. Be specific and detailed to avoid confusion or misunderstandings regarding the nature of the services rendered.

Itemized costs

Break down the costs associated with each service or material used as a separate line item. This may include labor charges, materials, equipment rental fees, travel expenses, and any applicable taxes or surcharges.

Include the following details for each item:

Quantity

Specify the number of units used for each material or the number of hours spent on a service.

Unit price

Indicate the cost per unit for each material or the hourly rate for labor charges.

Total cost

Display the calculated total cost for each line item by multiplying the quantity by the unit price.

Providing a detailed breakdown helps clients understand what they are being charged for and facilitates transparency in pricing.

Terms of payment

Clearly state the terms of payment, including the due date, accepted payment methods, and any late payment penalties or discounts for early payment. This ensures that both parties are aware of their obligations and helps expedite the payment process. Offering early payment discounts is an avenue you can use to incentivize faster settlements.

Payment instructions

Provide clear instructions on how payment should be made, whether it’s through bank transfer, credit card, check, or online payment platforms. Include relevant account details or payment links to streamline the payment process for the client.

Additional notes or terms

Include any additional terms or notes relevant to the transaction, such as warranty information, service guarantees, or special instructions for the client. This helps clarify expectations and minimizes potential disputes down the line.

Signature and authorization

If required, provide space for the client to sign and authorize the invoice, indicating their acceptance of the services rendered and agreement to the terms of payment. This serves as a formal acknowledgment of the transaction and can be useful for record-keeping purposes.

Choosing the right invoicing software for your business

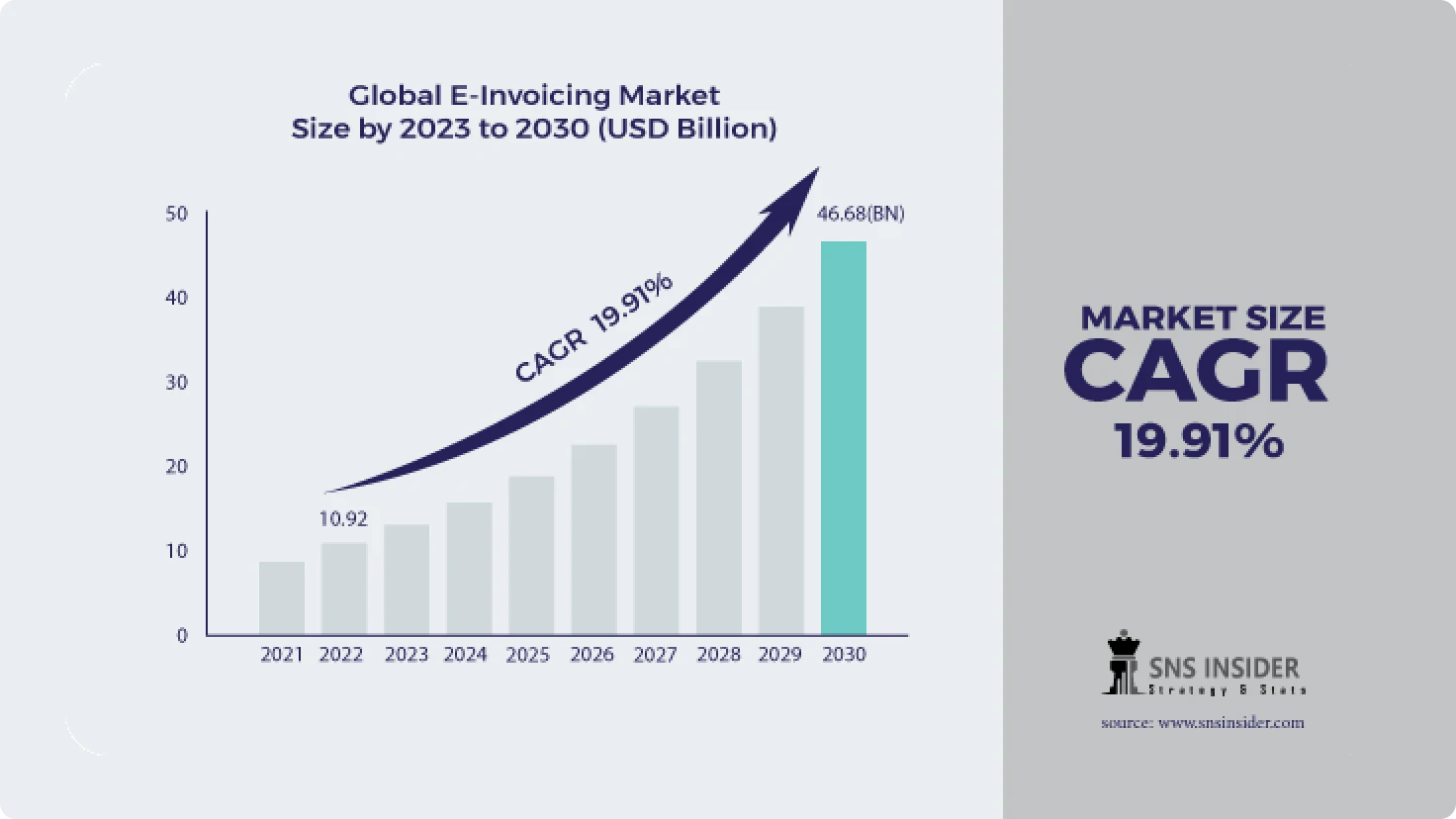

From the illustration above we see a steady increase in the use of electronic invoice automation. According to reports, the global invoicing software market was valued at $10.92bn in 2022 and is expected to reach USD 46.68 Bn by 2030, and grow at a CAGR of 19.91% over the forecast period 2023-2030. This significant growth is driven by several factors, including the rising adoption of digital payment methods, the increasing complexity of business transactions, and the need for automation to streamline operations.

Businesses of all sizes are recognizing the importance of efficient invoicing processes for maintaining cash flow, reducing administrative burdens, and enhancing customer satisfaction. With a plethora of invoice software options available in the market, choosing the right one can be a daunting task.

However, by understanding the key factors to consider and leveraging real statistical data, businesses can make informed decisions that align with their specific needs and objectives.

Features and functionality

One of the first considerations when selecting invoicing software is the range of features and functionality it offers. Businesses should assess their specific needs and look for software that provides essential features such as an invoice template, recurring billing, expense tracking, and payment reminders.

In addition, advanced features such as project management, time tracking, and client portals may be beneficial for certain businesses.

Scalability

As businesses grow and evolve, their invoicing needs may change. Therefore, it’s essential to choose software that can scale with the business. Scalability encompasses not only the ability to handle increased transaction volumes but also the flexibility to adapt to changing business requirements and processes. A study by Gartner found that 45% of businesses cite scalability as a key factor influencing their decision to invest in invoicing software.

Integration capabilities

In today’s interconnected business environment, integration with other systems and tools is crucial for seamless workflow automation and data synchronization. Businesses should look for invoicing software that offers integrations with accounting software, customer relationship management (CRM) systems, payment gateways, and other third-party applications.

The Brainy Insights, a market intelligence firm, has projected that the global invoice factoring market, valued at $2.74 trillion in 2022, is set to surge to a whopping $6 trillion by 2032. This growth is fueled by the increasing demand for alternative financing options and the need for businesses to address cash flow challenges.

Security and compliance

With the increasing prevalence of cyber threats and data breaches, security is a top concern for businesses when choosing invoicing software. The software should adhere to industry standards and regulations to ensure the confidentiality, integrity, and availability of sensitive financial information.

According to a report by PwC, a global consulting firm, 86% of businesses cite data security as a critical factor when evaluating invoicing software providers.

User-friendliness

Ease of use is another important consideration, especially for businesses with non-technical users. The invoicing software should have an intuitive interface and user-friendly design to minimize the learning curve and maximize productivity. A survey by Capterra, a software comparison site, found that 68% of businesses prioritize user-friendliness when selecting invoicing software.

Cost and pricing structure

Finally, businesses need to consider the cost and pricing structure of the invoicing software. While affordability is important, it’s essential to assess the overall value proposition and return on investment (ROI) offered by the software.

Tips for getting paid on time – Workiz Pay & Automation

For freelancers, contractors, and small businesses, ensuring timely payments is essential for financial stability. Late payments can disrupt cash flow, hinder growth, and create unnecessary stress. Studies show around 54% of businesses experienced late payments in 2020,hindering their ability to meet financial obligations

The good news is that with a proactive approach, you can significantly increase your chances of getting paid on time, every time.

To mitigate the risk of late payments and ensure a steady cash flow, businesses can implement several strategies and best practices. Here are some tips for getting paid on time:

1. Clear payment terms and policies

Clearly communicate your payment terms and policies to clients from the outset of your relationship. This includes specifying payment due dates, accepted payment methods, and any late payment penalties or discounts for early payment.

Using a free invoice app like Workiz has proven to be a powerful solution that helps businesses automate their invoicing, payment collection, and follow-up processes, ensuring timely payments and reducing administrative burdens. Once you set clear expectations upfront, you can reduce the likelihood of misunderstandings or disputes later on.

2. Invoice promptly and accurately

Send out invoices promptly after completing the work or delivering the product. Ensure that your invoices are accurate, detailed, and include all relevant information, such as a breakdown of charges, payment instructions, and any applicable taxes or fees. Using professional invoicing software, like Workiz, can streamline the invoicing process and help you create professional-looking invoices quickly and efficiently.

3. Offer multiple payment options

Provide your clients with multiple payment options to accommodate their preferences and streamline the payment process. This may include accepting credit cards, bank transfers, checks, and online payment platforms. Offering convenient payment methods makes it easier for clients to pay you promptly, reducing the risk of delayed payments.

4. Follow up on overdue invoices

Implement a systematic approach for following up on overdue invoices. Send friendly reminders to clients as soon as payments become overdue, reminding them of the outstanding balance and payment due date. Consider using automated reminders or scheduling follow-up calls to ensure consistent communication and prompt payment.

Online invoicing solutions, such as invoice simple tools offer user-friendly interfaces, customizable templates, and automated features for creating and managing invoices.

5. Establish personal relationships

Cultivate strong personal relationships with your clients and stakeholders to foster trust and accountability. Building rapport and open lines of communication can make it easier to address payment issues directly and resolve any concerns or disputes amicably. By maintaining positive relationships, you can encourage timely payments and reduce the likelihood of payment delays.

6. Offer incentives for early payment

Consider offering incentives for early payment, such as discounts or rewards, to incentivize clients to pay promptly. Conversely, you can impose late payment penalties for overdue invoices to deter late payments and encourage compliance with payment terms. However, be mindful of striking a balance between incentivizing prompt payment and maintaining profitability.

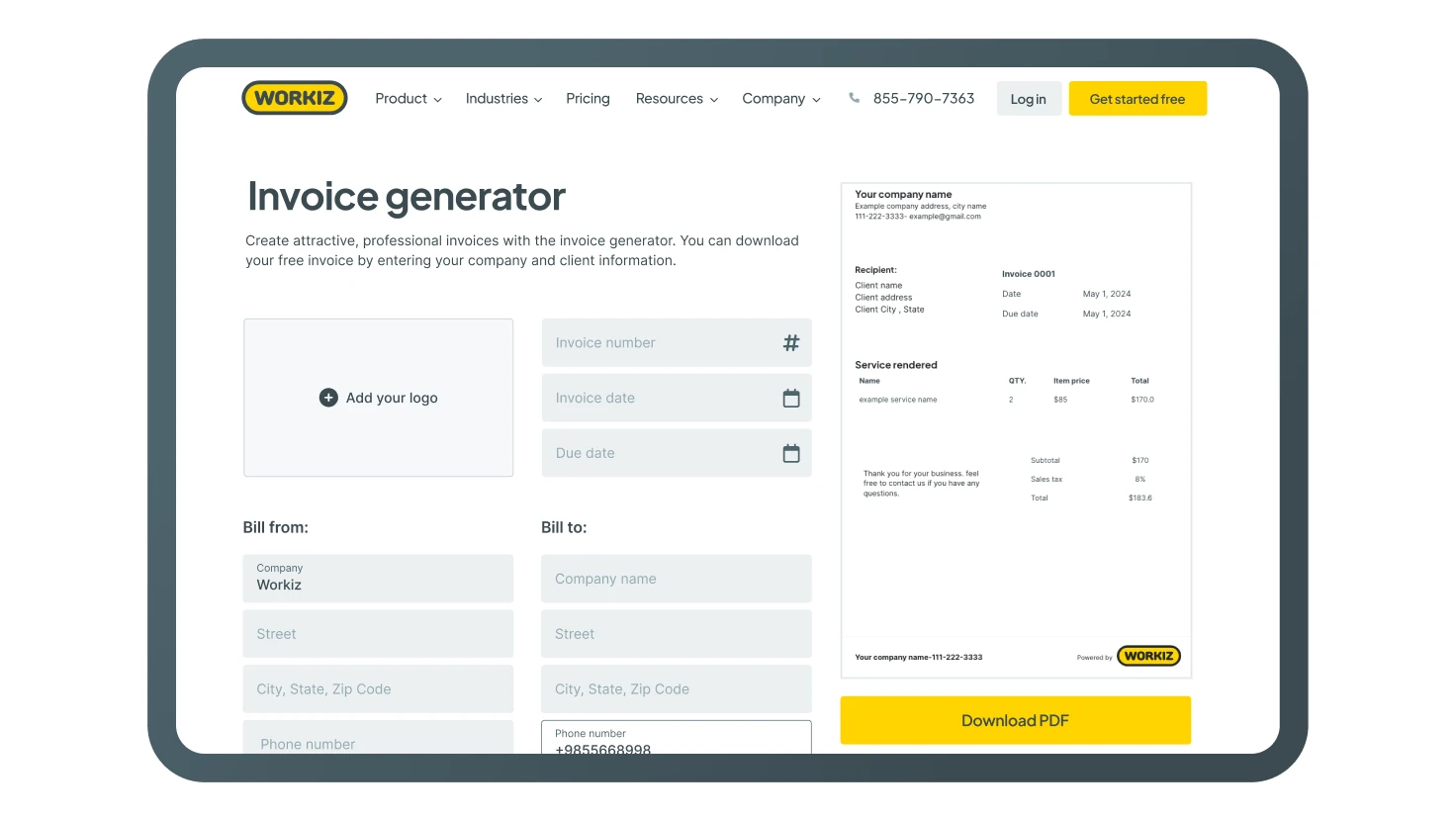

7. Utilize an invoice generator

Leveraging an online invoice generator can simplify the invoicing process and save time for businesses. With free invoice templates available online, businesses can easily create professional-looking invoices tailored to their specific needs.

Tools like the free invoice generator offered by Workiz provide customizable templates and user-friendly interfaces, allowing businesses to generate invoices quickly and efficiently.

Conclusion

A well-crafted invoice is a critical component of efficient billing and payment processes for field service companies. By following these steps and considering using field service management software, you can produce a simple invoicing process, ensure timely payments, and maintain positive client relationships. Remember, a well-designed invoice is not just a bill, it’s a professional reflection of your business which can elevate your services.

Common FAQ about invoice templates

In the world of business transactions, an invoice is like the blueprint of a deal, laying out all the important details. Let’s break down the must-haves in a simple way so you can create professional invoices with ease.

- Sender and recipient information. Think of this as a friendly introduction. Include your business name, address, and contact details, as well as those of your client. It’s like saying, “Hey, Here’s who we are, and here’s who you are.”

- Invoice date and due date. Dates matter. Tell your client when you sent the invoice (invoice date) and when you expect them to pay (due date). This avoids any confusion and keeps things running smoothly.

- Invoice number. Every invoice needs its own ID. This helps you keep track of things. Assign a unique number to each invoice – it’s like giving each transaction its own name.

- Itemized list of products or services. Break it down. Write out what you provided – whether it’s goods or services. Be specific. This part helps your client see exactly what they’re paying for.

- Costs and quantities. Get into the numbers. Show how much each item or service costs, and make it clear if there are different quantities. This helps avoid any confusion during the payment process.

- Total amount due. The bottom line. Add up all the costs, including any taxes or discounts, and that’s how you’ll have the total amount your client needs to pay. Keep it clear and straightforward.

- Payment terms. Set the rules. Let your client know when they need to pay and if there are any penalties for paying late. This ensures everyone is on the same page.

Understanding these components turns the process of creating invoices from a puzzle into a straightforward task. In the next step, we’ll explore more about formatting and essential details to make your own invoices stand out and keep your business transactions hassle-free. Stay tuned!

Creating an invoice for free is easier than you might think, we have created a free online tool which you use. Pick the general version or the industry specific tool:

- General invoice template

- Garage door invoice template

- HVAC invoice template

- Junk removal invoice template

- Locksmith invoice template

- Roofing invoice template

- Appliance repair invoice template

- Plumbing invoice template

- landscaping invoice template

Looking for a complete long lasting solution?

Simplify your financial management by effortlessly sending personalized, branded invoices directly from your mobile device with just one tap. Keep your accounting organized by automatically syncing all your invoices with QuickBooks Online, ensuring that your books are always up to date.

Never Miss a Payment Again

Stay on top of your financial obligations with our seamless payment reminder system. Effortlessly collect outstanding invoices while providing exceptional customer service. Our platform automatically sends polite payment reminders, ensuring your clients never overlook their dues. Customers can conveniently settle payments or leave deposits online, instantly receiving automated receipts for a hassle-free experience. Streamline your accounts receivable process and maintain a healthy cash flow with our user-friendly solution.how to create an invoice for free