Now, why is the creation of professional invoices so important? Picture this: In a world where first impressions are often lasting, your invoice is not just a receipt of a transaction; it’s a reflection of your professionalism, attention to detail, and commitment to excellence.

Creating professional invoices is not a mere formality; it’s a strategic move that speaks volumes about your business acumen. The importance lies not just in documenting a transaction but in presenting it with a touch of finesse. A professionally crafted invoice not only ensures timely payments but also cultivates a positive image, fostering trust and credibility in the eyes of your clients.

Basic invoice components: unveiling the essentials

In the world of business transactions, an invoice is like the blueprint of a deal, laying out all the important details. Let’s break down the must-haves in a simple way so you can create professional invoices with ease.

- Sender and recipient information. Think of this as a friendly introduction. Include your business name, address, and contact details, as well as those of your client. It’s like saying, “Hey, Here’s who we are, and here’s who you are.”

- Invoice date and due date. Dates matter. Tell your client when you sent the invoice (invoice date) and when you expect them to pay (due date). This avoids any confusion and keeps things running smoothly.

- Invoice number. Every invoice needs its own ID. This helps you keep track of things. Assign a unique number to each invoice – it’s like giving each transaction its own name.

- Itemized list of products or services. Break it down. Write out what you provided – whether it’s goods or services. Be specific. This part helps your client see exactly what they’re paying for.

- Costs and quantities. Get into the numbers. Show how much each item or service costs, and make it clear if there are different quantities. This helps avoid any confusion during the payment process.

- Total amount due. The bottom line. Add up all the costs, including any taxes or discounts, and that’s how you’ll have the total amount your client needs to pay. Keep it clear and straightforward.

- Payment terms. Set the rules. Let your client know when they need to pay and if there are any penalties for paying late. This ensures everyone is on the same page.

Understanding these components turns the process of creating invoices from a puzzle into a straightforward task. In the next step, we’ll explore more about formatting and essential details to make your own invoices stand out and keep your business transactions hassle-free. Stay tuned!

Invoice templates

In the world of invoices, where clarity and speed matter, let’s talk about a game-changer: invoice templates. These ready-made gems can save you time and give your invoices a professional touch. Let’s break down why they’re your invoicing superhero and where you can snag them, free or with a bit more jazz.

Here are some benefits of using a pre-designed invoice:

- Time saver extraordinaire. Think of templates like a magic wand that cuts your invoicing time. Instead of starting from zero, you get a head start. In other words, they are quick and efficient.

- Professionalism on autopilot. Templates come with a polished look, making you look like a pro without the designer hassle. It’s like putting on a sharp suit without the effort.

- Structured and organized. Templates also act as a helpful guide, making sure you cover all the necessary information – your details, what you sold, payment terms. When you’re done it will feel like having a checklist for everything.

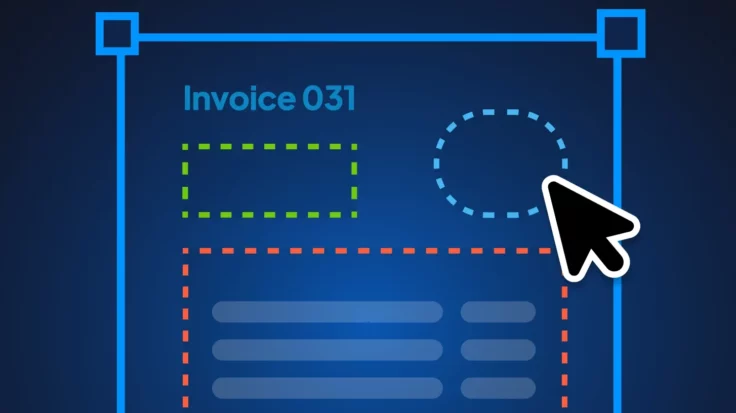

- Easy customization. While templates have a structure, they’re not set in stone. You can tweak them to match your style – add your logo, change colors. It’s like having a customizable tool that still fits your unique vibe.

Where to find free or paid templates online

When it comes to invoice creation, finding the right template can be a game-changer. Here are some online platforms where you can discover both free and paid templates:

- Microsoft Office Templates

- Google Docs Templates

- Template.net

- Wave

Whether you go for the freebies or treat yourself to a paid option, these places offer a variety of templates to suit your needs. Think of it as choosing the perfect tool for your job, making invoices a breeze.

Step-by-step guide to creating an invoice

Navigating the labyrinth of invoicing doesn’t have to be a maze. With a step-by-step approach, creating a professional invoice from scratch becomes as straightforward as a walk in the park. Let’s break down each step, ensuring you know how to prepare the invoice seamlessly.

- Step 1: gather your information. Before diving into making invoices, you have to gather all the necessary details – your business info, logo, and any specifics about the products or services you’re invoicing.

- Step 2: choose an invoice format. The next step is to decide on the format that suits your business style. Whether it’s a simple document or a stylish template, choosing the right format sets the stage for a professional presentation.

- Step 3: create the invoice header. Now it is necessary to introduce and write an invoice with a clear header. Place your business name, logo, and contact details at the top. Like a cover of a book, this is usually the first thing your client sees.

- Step 4: add the recipient’s information. Include your client’s details below yours. Similar to addressing an envelope – this ensures your invoice reaches the right destination.

- Step 5: assign an invoice number. Give your invoice its unique identity by assigning a number. Just think of this as giving each piece of mail its own tracking code. This makes organization a breeze.

- Step 6: specify dates. Clearly state the date of the invoice and the due date for payment. This acts as a way of putting timestamps on your transactions – keeping things clear and on schedule.

- Step 7: list your products or services. Get to the heart of the matter. List out what you’re charging for – products or services – along with their costs. It is almost like creating a menu for your client to choose from.

- Step 8: include taxes and discounts. If applicable, add taxes or discounts. Be clear about these extra costs. You don’t want any surprises for your client regarding the cost or price of your services.

- Step 9: specify payment details. Lay out the payment terms. Date due, fees? This way, you’re ensuring everyone knows what to expect.

- Step 10: add additional notes. If there’s anything extra to mention – special instructions, terms, or additional info – add it in the notes section. Think of this as a little side note for clarity.

- Step 11: review and proofread. Before you hit send, review your masterpiece. Check for typos or errors. This should be your final check before sending a crucial email.

- Step 12: send the invoice. Hit that send button and dispatch your invoice to your client.

- Step 13: follow up. Once you’ve sent the mail, don’t stop there. Follow up on the due date to ensure timely payments. You need to confirm if your letter arrived – making sure everything went smoothly. Using a Field service invoicing software – Workiz can also make your invoicing process a lot easier to carry out.

With these steps, creating a professional invoice becomes a structured process, ensuring your financial transactions are not just smooth but also leave a lasting positive impression.

Digital tools for invoicing

In the world of business, where time is money, leveraging digital tools for invoicing is akin to having a reliable co-pilot for your financial journey. Let’s look at some popular invoicing software and tools, exploring how they bring efficiency and finesse to the invoicing process.

QuickBooks

- Comprehensive bookkeeping: QuickBooks not only handles invoicing but also integrates seamlessly with your overall financial management.

- Automated recurring invoices: set it and forget it – schedule recurring invoices to save time and ensure timely billing.

- Expense tracking: keep tabs on your business expenses effortlessly, creating a comprehensive financial overview.

Wave

- Free Invoicing: wave offers free invoicing tools, making it an ideal choice for small businesses.

- Customizable templates: Tailor your invoices to match your brand, adding a personal touch without the design hassle.

- Real-time tracking: Monitor the status of your invoices in real-time, keeping you in the loop on payments.

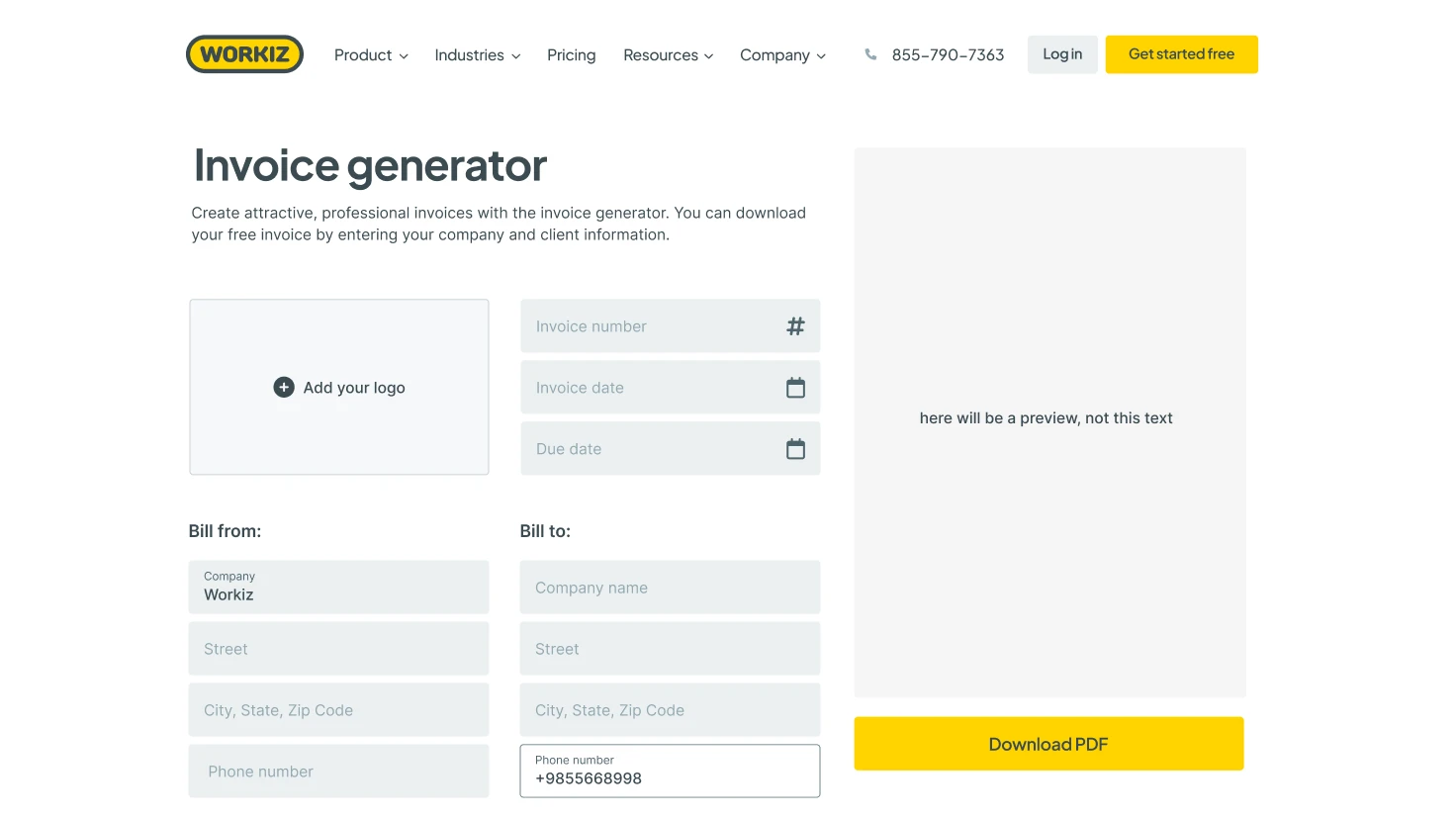

Workiz online invoice generator

Online invoicing generators

- User-friendly interface: these generators are designed with simplicity in mind, making them accessible to users with varying tech expertise.

- Instant invoicing: create and send invoices on the spot, ensuring swift communication with clients.

- Cloud-based access: access your invoicing tools from anywhere, providing flexibility for on-the-go business.

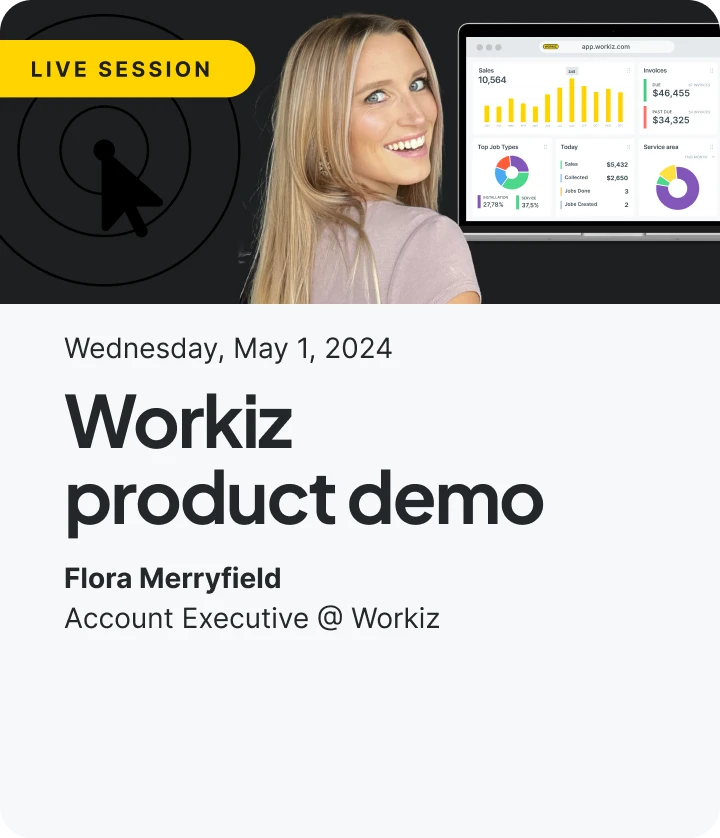

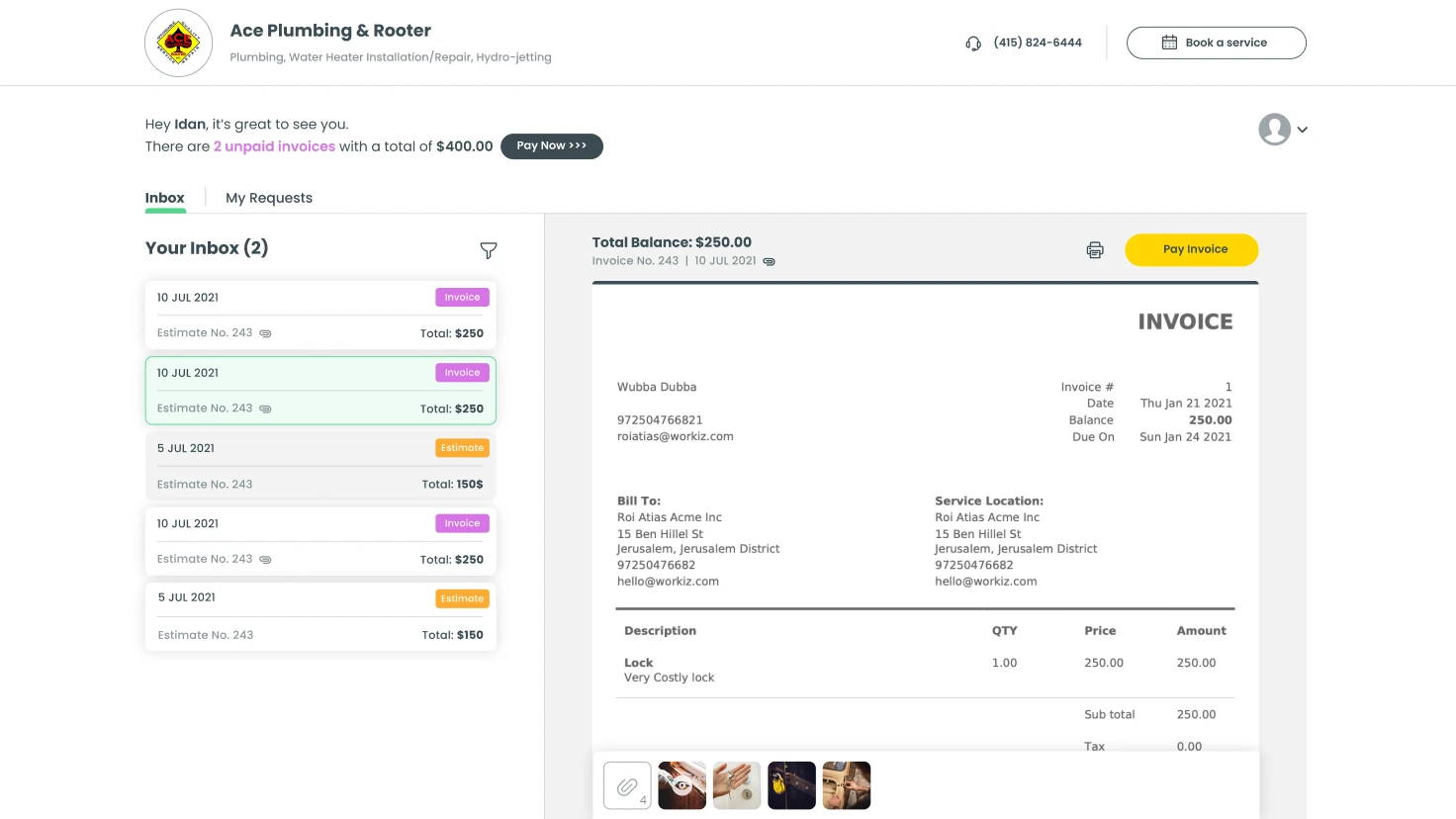

Meet Workiz invoicing capabilities

Workiz stands out as a comprehensive solution for businesses, seamlessly integrating invoicing into its broader job management system. Here’s a brief glimpse of the invoicing prowess that Workiz brings to the table:

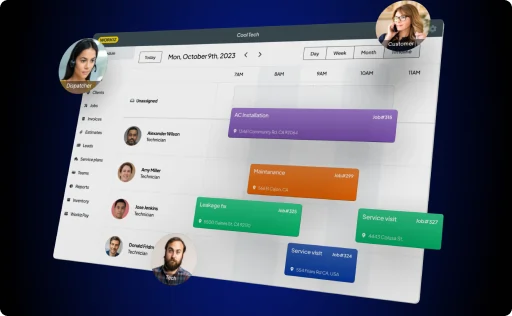

- Job management integration. Workiz goes beyond standalone invoicing. It integrates invoicing seamlessly into its job management system. This integration ensures a unified workflow, allowing you to manage your jobs and finances in one centralized platform.

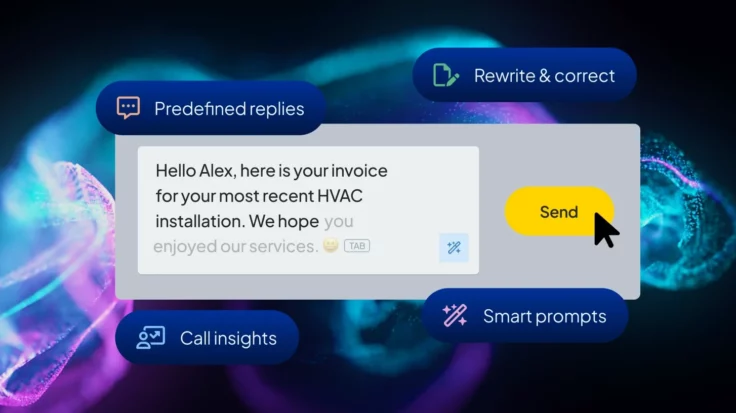

- Client communication simplified. Communicate directly with clients through the Workiz platform. This feature streamlines interactions, reducing the need for multiple tools. It’s like having a dedicated space for all your client-related communication.

- Automated reminders for due dates. Workiz understands the importance of timely payments. With automated reminders for due dates, it minimizes the need for manual follow-ups. It’s like having a virtual assistant that keeps your invoicing on track without you lifting a finger.

In summary, Workiz combines invoicing capabilities with a holistic approach to job management and client communication. It’s not just an invoicing tool; it’s a strategic ally in simplifying and optimizing your overall business operations.

Best practices for effective invoicing: mastering the art of prompt payments

In the symphony of business transactions, effective invoicing is the conductor that ensures a harmonious financial tune. To encourage prompt payments and maintain consistency, consider these best practices:

- Clear and concise invoices. Keep it simple and straightforward. Clearly outline the products or services, costs, and payment terms. It’s like creating a roadmap that your clients can easily follow.

- Professional design. Present your invoices with a professional touch. Use clean, well-designed templates and include your business logo. It makes for a positive impression.

- Consistency is key. Maintain consistency in your invoicing process. Use the same format and style for all your invoices. It’s like establishing a brand identity for your financial transactions.

- Set clear payment terms. Specify due dates and any penalties for late payments. Clarity in payment terms reduces confusion and encourages timely payments. It’s like setting expectations from the start.

- Provide multiple payment options. Cater to your clients’ preferences by offering various payment methods. Whether it’s credit cards, bank transfers, or online platforms, the more options, the better. It’s like providing different doors for your clients to walk through.

Follow-up and tracking

Following up and tracking your sent invoices is not just a good practice; it’s a strategic move that keeps your financial ship sailing smoothly.

Importance of tracking sent invoices

- Visibility and control. Tracking sent invoices provides you with real-time visibility into the status of each transaction. It’s your radar system, allowing you to steer your financial ship with precision.

- Timely action. Knowing which invoices are outstanding enables you to take immediate action. It’s your early-warning system, giving you the opportunity to navigate around potential storms.

- Cash flow management. Effective tracking is a cornerstone of cash flow management. It acts as your financial GPS, guiding you through the twists and turns of your business finances, ensuring a smooth journey.

Methods for following up on unpaid invoices

- Friendly reminders. Send courteous reminders as the due date approaches. A gentle prompt can encourage clients to prioritize your invoice.

- Phone calls. For overdue invoices, a personal touch can be effective. A friendly phone call demonstrates your commitment to resolving the issue directly.

- Automated systems. Utilize automated reminders and follow-up systems. These tools serve as your personal assistant, consistently sending reminders and freeing up your time for more strategic tasks.

- Professional communication. Maintain professionalism in your communication. Clearly state the importance of timely payments and any potential consequences for late payments.

- Negotiation and flexibility. In some cases, clients may be facing challenges. Be open to negotiation and offer flexible solutions, finding alternative routes when faced with unexpected detours.

Legal considerations

Creating invoices is not just about numbers; it involves sailing through the legal seas. Here are key legal considerations to keep in mind:

- Tax regulations. Ensure your invoices comply with tax regulations. Include necessary tax details and stay informed about any changes in tax laws. It’s like keeping your financial ship sailing smoothly in the legal sea.

- Document retention. Keep copies of your invoices for record-keeping purposes. It’s like building a paper trail that can be crucial in case of audits or disputes. Navigating the landscape of effective invoicing involves a combination of clear communication, strategic follow-up, and adherence to legal considerations. Mastering these practices ensures that your financial transactions not only run smoothly but also contribute to the overall success of your business.

- Payment terms and late fees. Clearly outline your payment terms, including due dates and any applicable late fees. This not only sets expectations but also holds legal weight in case of payment disputes. Be sure your terms comply with local laws.

- Invoice numbering. Assign unique and sequential invoice numbers. In some jurisdictions, there may be legal requirements for the format or structure of invoice numbers. Adhering to these ensures consistency and compliance.

Conclusion

Invoicing isn’t just paperwork; it’s your financial handshake with clients. Simplify with templates, follow a step-by-step guide, and employ follow-up strategies. Stay legal, stay consistent. Now, armed with insights, go ahead – start creating invoices that echo professionalism and prompt payments.

So, are you ready to take your invoicing to the next level? Explore the comprehensive invoicing capabilities of Workiz, seamlessly integrated into a holistic job management system. Your financial success awaits – try Workiz today!