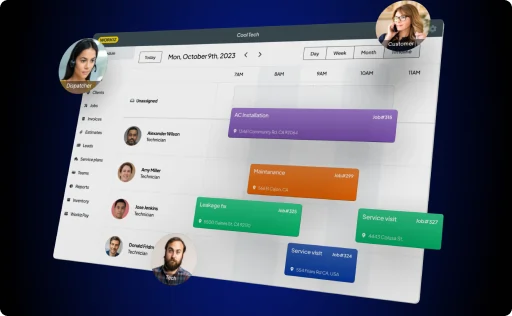

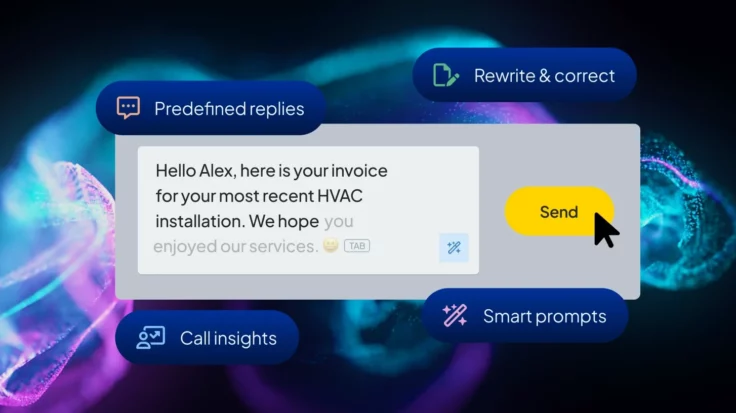

Apps such as FreshBooks bring user-friendly interfaces and cloud-based accessibility to the table, ensuring flexibility and convenience. For freelancers, Workiz emerges as a budget-friendly choice, offering not only invoicing features but an entire suite of financial tools.

Top invoice apps in the market

In the fast-paced world of business, having the right tools at your fingertips can make all the difference. When it comes to invoicing, these top-notch apps stand out, offering a blend of user-friendly interfaces, robust features, and unique functionalities.

QuickBooks

QuickBooks, a leader in the accounting realm, provides a comprehensive solution for businesses. With its user-friendly interface and robust features, it simplifies accounting and elevates the invoicing experience. Whether you’re a small startup or an established enterprise, QuickBooks caters to all, proving itself as one of the top apps to send invoices ensuring efficient financial management.

Unique features

- User-friendly Interface: QuickBooks is renowned for its intuitive design, making it accessible to users with varying levels of accounting expertise.

- Robust Features: Beyond being an invoicing app, QuickBooks offers a suite of features, including automatic payment reminders and detailed reporting tools.

Pricing model

- Plans start at $25/month for basic features, with additional add-ons for advanced functionality.

User reviews

- QuickBooks is consistently rated highly for its ease of use, comprehensive features, and excellent customer support. However, some users find the pricing to be on the higher end.

FreshBooks

Tailored for freelancers and small businesses, FreshBooks is a go-to choice for those seeking an all-in-one solution. From invoicing to expense tracking and time management, FreshBooks streamlines financial processes, empowering users to focus on what they do best.

Unique features

- That cater to the intricacies

Pricing model

- FreshBooks offers four plans: Lite ($17 per month), designed for sole proprietors and gig workers

- Plus ($30 per month), which adds more standard business features

- Premium ($55 per month), a more advanced business app

- Custom pricing

User reviews

- FreshBooks is generally well-received for its ease of use, affordability, and helpful customer support. Some users might find the features limited compared to more robust solutions.

Wave

For freelancers and small businesses on a budget, Wave emerges as a one of the best invoicing apps for android powerful and free invoicing accounting solution. It strikes a balance between essential features and cost-effectiveness.

Unique features

- Completely free to use with no hidden costs or limited features.

- Simple and intuitive interface for easy navigation.

Pricing model

- Wave Payroll costs a $20 monthly base fee, plus $6 per employee or contractor. A 30-day free trial is available.

User reviews

Users praise Wave for its affordability, simplicity, and the fact that it offers a comprehensive set of features without the hefty price tag.

Zoho Invoice

As part of the Zoho suite of business applications, Zoho Invoice positions itself as a versatile solution for businesses seeking a holistic approach to financial management. Beyond offering invoicing capabilities, it seamlessly integrates with other Zoho products, providing a comprehensive ecosystem for businesses to thrive.

Unique features

- Seamless integration with other Zoho applications like Zoho CRM and Zoho Books.

- Customizable workflows to automate various tasks.

- Mobile app for on-the-go access and management..

Pricing model

- Zoho Invoice is completely free for its users

User reviews

Users commend Zoho Invoice for its seamless integration, customization options, and the ability to streamline invoicing alongside other essential business functions.

Xero

Xero is one of the best invoicing apps that takes invoicing to the cloud, offering a comprehensive mobile invoice software solution that goes beyond invoicing. With bill management and third-party app integration, Xero provides businesses with a robust platform for financial management.

Unique features

- Real-time financial data and reports for better business insights.

- Automated bank feeds and reconciliation for streamlined accounting.

Pricing model

- Early. Usually $15 · 50 · Save $30

- Growing. Usually $42 · 21 · Save $84

- Established. Usually $78 · 39 · Save $156

User reviews

Users appreciate Xero for its automation capabilities, scalability, and the ability to integrate seamlessly with a wide range of business apps.

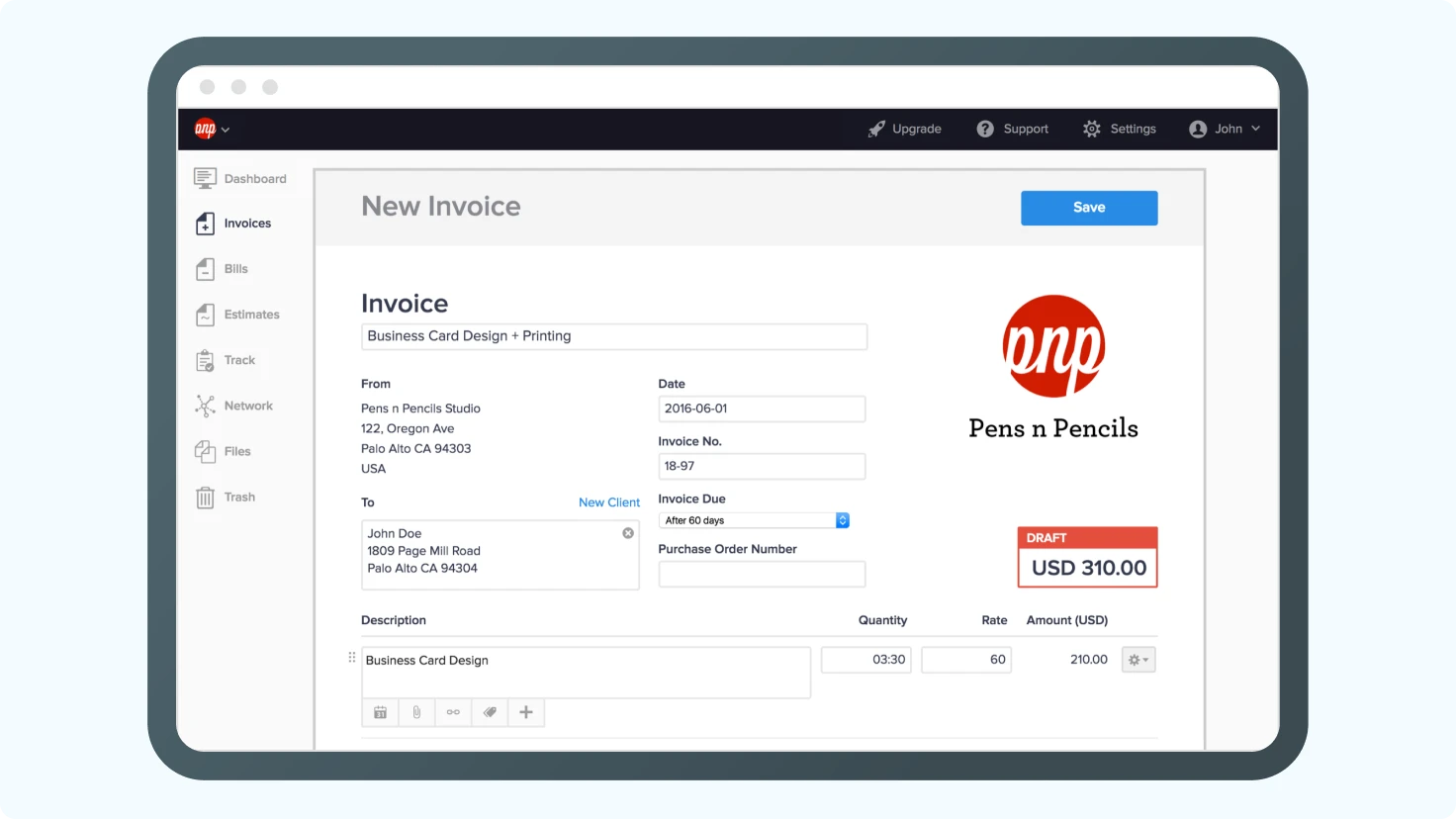

Invoicely

Invoicely stands out in the realm of simplicity, offering a straightforward and free invoicing software solution. Designed for ease of use, Invoicely serves as one of the most user-friendly apps to create invoices and send invoices without unnecessary complexities.

Unique features

- Simple and intuitive interface for easy navigation and use.

- Free plan available with essential features.

- Affordable paid plans with additional features like recurring invoices and online payments.

Pricing model

- FREE PLAN: $0.00 per month

- BASIC PLAN: $9.99 per month

- PROFESSIONAL PLAN: $19.99 per month

- ENTERPRISE PLAN: $29.99 per month

User reviews

Users praise Invoicely for its simplicity, the absence of hidden costs, and the ability to generate professional-looking invoices without hassle.

Harvest

Harvest is another top invoice app that caters to businesses that value time tracking alongside invoicing. As a time tracking and invoicing tool, Harvest empowers businesses to efficiently track billable hours and manage expenses.

Unique features

- Accurate time tracking with features like project timers and team reporting.

- Seamless integration with various project management tools.

- Robust reporting and analytics for better project insights.

Pricing model

- HARVEST PLAN: Ideal for freelancers and solopreneurs: 1 Seat 2, Projects, $0 free forever

- HARVEST PRO: Perfect for teams, startups, and growing businesses. Unlimited seats, Unlimited projects, $10.80/seat/month (Billed Annually)

User reviews

Users appreciate Harvest for its robust time tracking functionality, intuitive interface, and the seamless integration of invoicing with other financial tools.

Square invoices

Square steps into the invoicing arena with a tool seamlessly integrated into their invoice and payment app processing system. Ideal for businesses already leveraging Square for payments, Square Invoices streamlines the invoicing process, offering a convenient and cohesive financial solution.

Unique features

Payment Integration: Square Invoices’ integration with Square’s payment processing system ensures a frictionless experience from invoicing to payment receipt.

Business Synergy: For businesses utilizing Square across multiple facets, Square Invoices adds an additional layer of coherence to financial operations.

Pricing model

- Square Invoices typically charges a fee per invoice, with transparent pricing set $445 for unlimited invoicing.

User reviews

- Users commend Square Invoices for its seamless integration with Square payments, reducing the hassle of reconciling different financial tools.

PayPal Invoicing

In the realm of online transactions, PayPal extends its reach with a simple yet effective invoicing solution. Integrated with PayPal’s payment processing services, PayPal Invoicing caters to the needs of online businesses and freelancers.

Unique features

- Payment Integration: PayPal Invoicing is tightly integrated with PayPal’s payment gateway, ensuring a smooth transition from invoicing to receiving payments.

- Global Accessibility: With PayPal’s international reach, businesses can leverage PayPal Invoicing for seamless cross-border transactions.

User reviews

Users appreciate PayPal Invoicing for its simplicity, global accessibility, and the familiarity of leveraging PayPal for both invoicing and payment processing.

Hiveage

Hiveage positions itself as a versatile solution, offering an array of invoicing and billing features tailored for businesses. With time tracking, online payments, and recurring invoices, Hiveage becomes a comprehensive tool for financial management.

Unique features

- Hiveage goes beyond basic invoicing, incorporating time tracking, online payment options, and the ability to set up recurring invoices.

- Customizable invoices with branding and advanced features like project budgeting and client portals.

Pricing model

- FREE. For entrepreneurs just starting up $0 per month.

- BASIC. Ideal for the savvy freelancer. $16 per month. 50 Clients.

- PRO. Perfect for running your small business like a pro. $25 per month.

- PLUS. $42 Per month

User reviews

Users applaud Hiveage for its feature-rich offerings, intuitive design, and ability to manage diverse aspects of invoicing and billing within a single platform.

Due

Designed with freelancers and small businesses in mind, Due enters the scene as a free invoicing and time tracking software. With a focus on simplicity and functionality, Due caters to those looking for essential tools without financial commitment.

Unique features

- Free Invoicing: Due’s free model makes it an accessible choice for freelancers and small businesses looking to manage their finances without additional costs.

- Time Tracking: Due incorporates time tracking features, providing users with a holistic solution for invoicing and time management.

Pricing model

- BASIC. Free LIFETIME. 1% Interest on your money.

- PREMIUM. $10 PER MONTH.

User reviews

Users appreciate Due for its simplicity, the inclusion of time tracking, and the fact that it provides essential invoicing features without a subscription fee.

Invoice2go

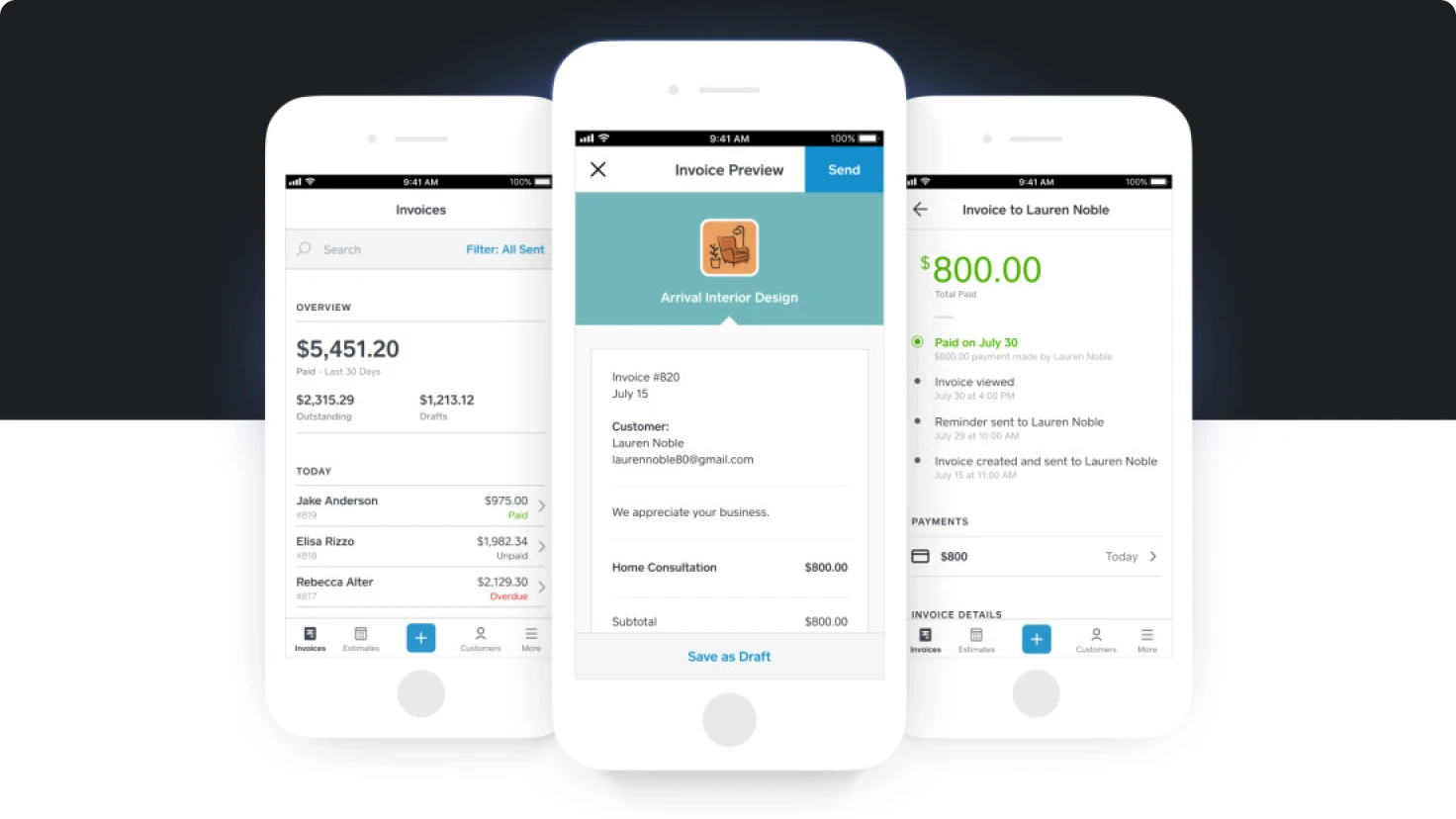

For businesses on the move, Invoice2go adopts a mobile-first approach to invoicing and expense management. With a focus on accessibility, Invoice2go empowers users to handle financial tasks anytime, anywhere.

Unique features

- Mobile-First Design: Invoice2go prioritizes a mobile-friendly interface, catering to businesses where professionals are constantly on the go.

- Invoicing and Expense Management: Beyond invoicing, Invoice2go includes features for expense management, providing a comprehensive mobile solution.

Pricing model

- Plans start at $5.99/month for basic features.

User reviews

Users commend Invoice2go for its mobile accessibility, ease of use, and ability to manage both invoicing and expenses seamlessly.

How to choose the right invoice app

In the vast sea of invoice apps, finding the perfect match for your business can be a game-changer. To navigate this decision-making process effectively, follow this step-by-step guide to ensure you choose an app that aligns seamlessly with your needs.

1. Define your requirements

Begin your quest by identifying your unique business needs. Are you a freelancer in need of streamlined invoicing, or does your enterprise require comprehensive accounting features? Clearly outline your requirements, considering aspects such as invoicing frequency, client collaboration, and financial reporting.

2. Budget considerations

Set a realistic budget for your invoicing needs. Invoice apps come with a variety of pricing models, from subscription-based plans to per-invoice fees. Understand the cost structures and choose an app that not only fits your budget but also provides the features essential for your business operations.

3. User-friendly interface

The importance of a user-friendly interface cannot be overstated. Opt for an app with an intuitive design, as it contributes significantly to efficiency and reduces the learning curve for you and your team. A well-designed interface streamlines your invoicing process, allowing you to focus on core business activities.

4. Compatibility

Consider the devices and operating systems your team uses. Ensure the selected invoice app is compatible across different platforms, including desktops, laptops, and mobile devices. This ensures flexibility and accessibility, allowing you to manage your finances on the go.

5. Security and data protection

Protecting sensitive financial data is paramount. Choose an invoice app with robust security measures to safeguard your information. Look for features like data encryption and secure payment gateways to ensure the confidentiality and integrity of your financial transactions.

6. Integration with other tools

Efficiency is enhanced when your invoice app seamlessly integrates with other tools. Consider apps that integrate with your accounting software, project management tools, and other business applications. This integration streamlines workflows, reduces manual data entry, and enhances overall productivity.

7. User reviews and recommendations

Harness the power of user experiences. Read reviews from other businesses, particularly those in your industry or with similar needs. Real-world feedback provides valuable insights into the app’s strengths and weaknesses, helping you make an informed decision.

8. Free trials and demos

Before committing to a long-term relationship with an invoice app, take advantage of free trials and demos. This hands-on experience allows you to explore the app’s features, assess its compatibility with your workflow, and ensure it meets your expectations before making a final decision.

Conclusion

As businesses and freelancers navigate the dynamic landscape of commerce, these digital tools emerge as indispensable allies, streamlining invoicing processes, enhancing client relationships, and fostering overall financial agility.

Through this exploration, we’ve unveiled the diverse array of invoice apps, each boasting unique strengths and catering to specific business needs. From the comprehensive accounting prowess of QuickBooks to the freelancer-friendly features of FreshBooks, and the budget-conscious appeal of Wave, businesses can find a tailored solution that aligns seamlessly with their requirements.

The decision-making process, however, demands a strategic approach. Defining specific needs, setting realistic budgets, prioritizing user-friendly interfaces, ensuring compatibility, and emphasizing security are crucial steps in selecting the perfect invoice app. User reviews and hands-on experiences through free trials further empower businesses to make informed choices.

FAQs

An invoice app is a digital tool that helps you create, send, and track invoices electronically. It simplifies the invoicing process, saves time, and improves your cash flow. Whether you’re a freelancer, a small business owner, or working for a larger company, an invoice app can streamline your financial management and professional image.

The ideal features will depend on your specific needs, but here are some key considerations:

Ease of use, invoicing feature reminders, and payment integrations, expense tracking, Time tracking invoicing, reporting and analytics, payment history, and customer data analysis.

Many invoice apps offer mobile versions for on-the-go access and management. You can create invoices, send them to clients, and track payments directly from your phone or tablet. Look for apps specifically designed for mobile usability.

Invoice apps primarily focus on creating and managing invoices. Accounting software, on the other hand, offers a more comprehensive financial management suite, including accounts payable and receivable, general ledger, payroll, and reporting features. While some invoice apps offer basic accounting functionalities, dedicated accounting software provides a more in-depth solution for complex financial needs.

Many invoice apps offer automated late payment reminders and escalation options. You can customize these settings to send automatic emails or reminders at specific intervals based on your payment terms. Some apps also integrate with payment processing systems to automatically charge late fees if payments are not received on time.

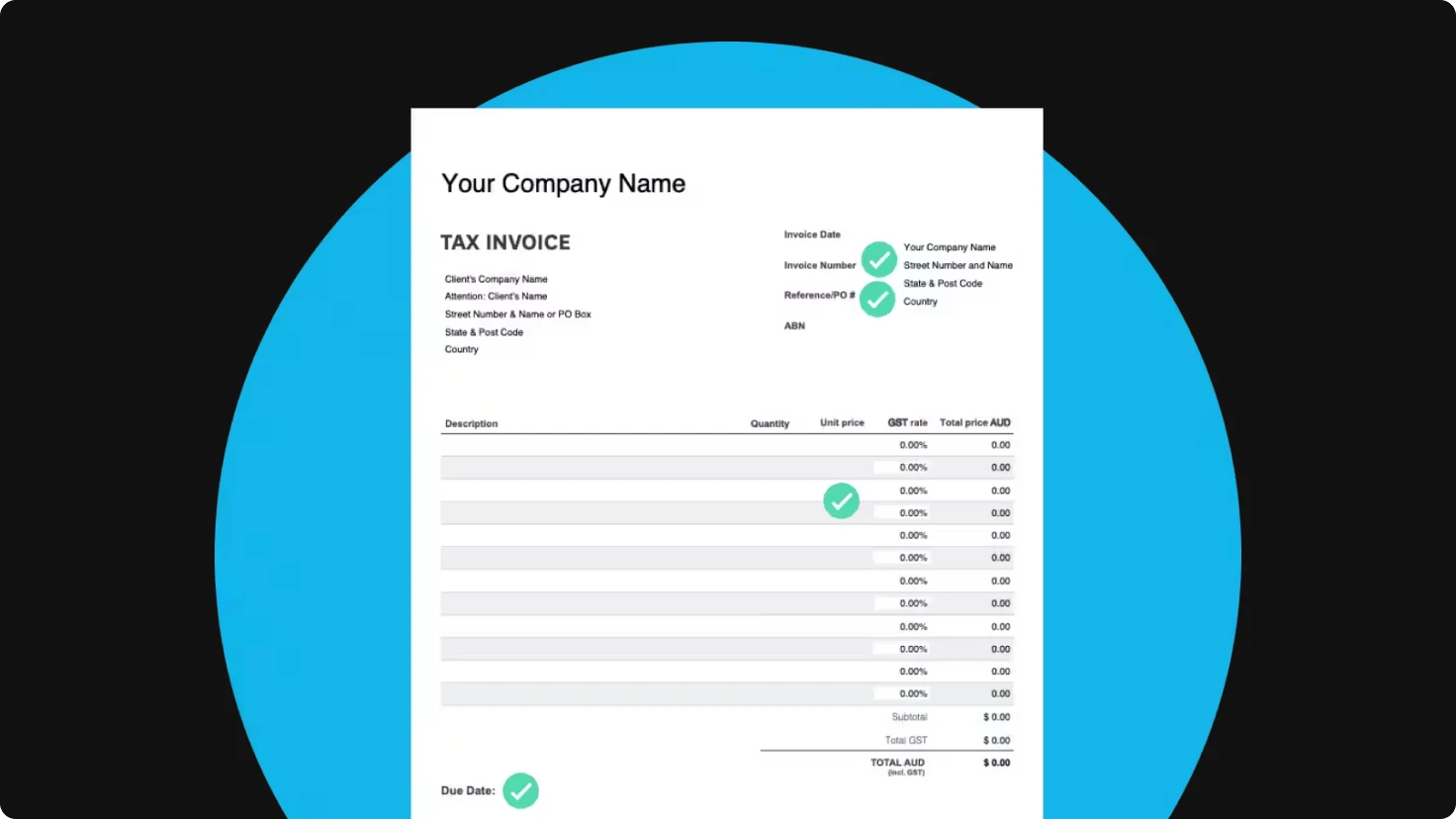

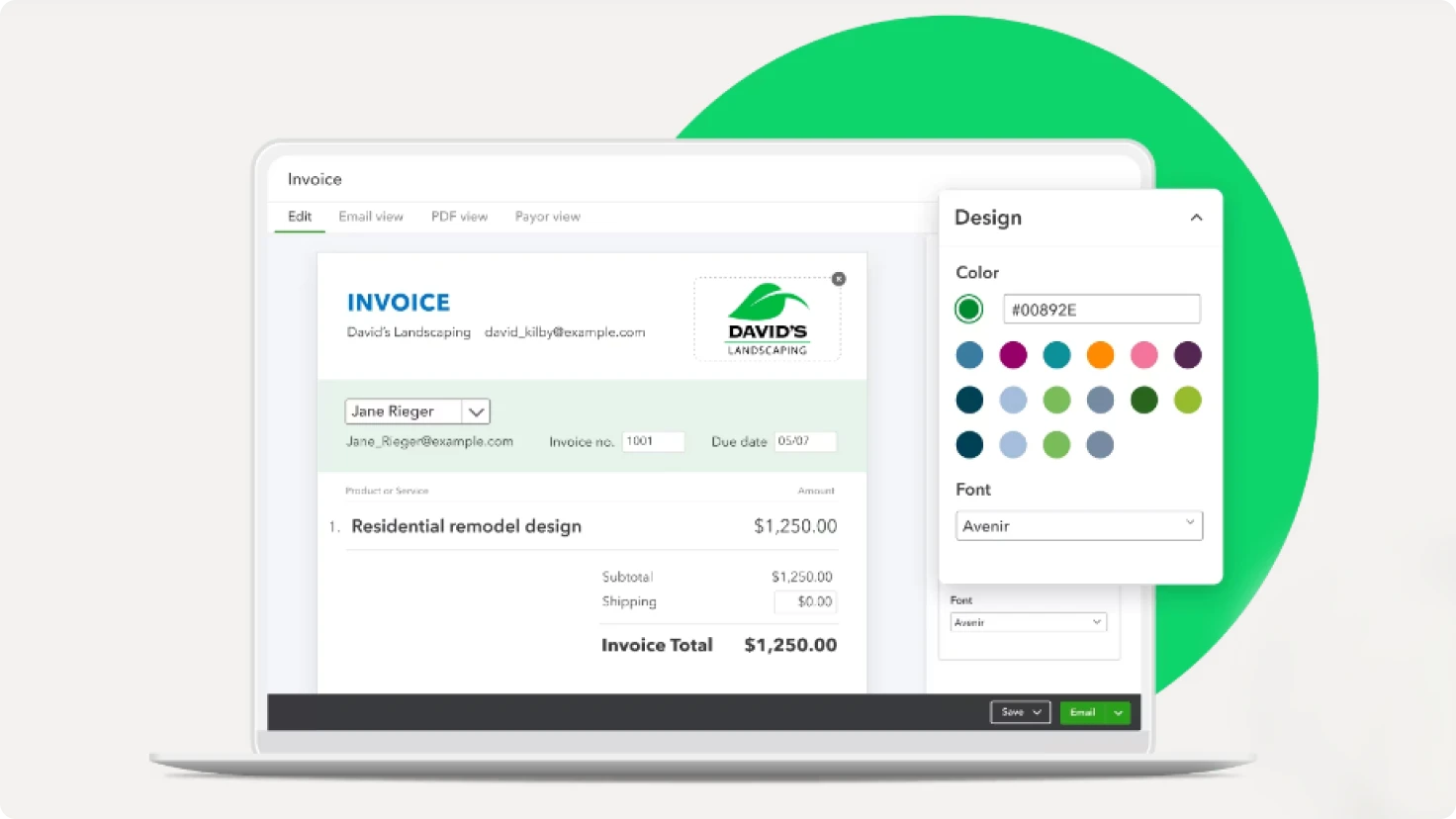

Yes, most invoice apps allow you to upload your logo and choose your brand colors and fonts. You can also customize invoice templates with company information, contact details, and preferred terms and conditions. This helps create professional and consistent invoices that reflect your brand identity.

Some invoice apps support multiple currencies and languages, making them ideal for international businesses or those working with clients in different locations. This eliminates the need for manual currency conversions and translations, simplifying the invoicing process for both you and your clients.