In the news, they call situations like this “inflation” – defined as a general increase in the prices of goods and services in an economy. The consumer price index, which measures these prices, says they increased by 8.5% in March compared to last year. In Canada, they have reached the highest record since 1991, and the rest is yet to come.

As inflation takes a toll on the American economy, field service businesses need to be mindful of how they spend their money. Gas and gear are just two of the many things seeing a price increase, so it’s crucial to find ways to cut costs where possible.

On the other hand, even a crisis (especially one that is going to last) can turn into an opportunity, or in the words of Warren Buffet: “when inflation is high, the best thing you can do is be exceptionally good at something.” As service pros, we all know what we’re good at, just as we know our services are still in high demand. We just need to know how to earn more to cover costs. And luckily, there are still growth opportunities, even in tough times like these.

So how can service pros beat the inflation crisis with their heads held high? Same as we did with Covid, while addressing the new challenges, making adjustments (by cutting costs and improving efficiency), and elevating growth opportunities. Let’s break down all of these step by step.

How does inflation challenge the field service industry?

Higher business costs

Inflation can be a challenge for any industry, but it seems to have an extra-large impact on field service. After all, our businesses are directly impacted by the rising cost of goods, which can quickly eat into our profits. The most obvious example is gas, as most of us can’t go from one job site to another on foot or using a bike, especially considering these high temperatures. But we also have to spend a lot more on the vehicles themselves, as well as gear, uniforms, office space, and whatnot.

Lower rates

People with less money in their pockets are less likely to spend on discretionary items like home repairs and maintenance services. And even if they can’t skip them (as the repair is critical and cannot wait), many of them are expected to ask you to lower your rates. If you refuse to do so this time, someone else might, as they also have expenses to cover.

Lower savings

As the balance changes between what you have in cash and what you now need to spend, so may your plans to grow your business or hire more employees. While we can’t tell you to postpone these plans (some may say that this is the perfect time to execute them, as many employees are back on the job market), we advise you to be careful. Experts believe it would take the North American economy a few years to go back to how it was, so you better have some backup in case expansion efforts don’t work out as planned.

What can you do to adjust?

Consider your savings

Talk to your accountant or financial advisor to better understand what inflation means for you and your business. They can help you make informed decisions about how to best protect your interests, regardless of whether you have money reserves or not.

Rethink expenses

See if there are any areas where you can cut back, starting by looking for discounts and deals. For example, you may want to renegotiate contracts with vendors or find ways to get discounts on the products and services you purchase now that you’re a regular customer.

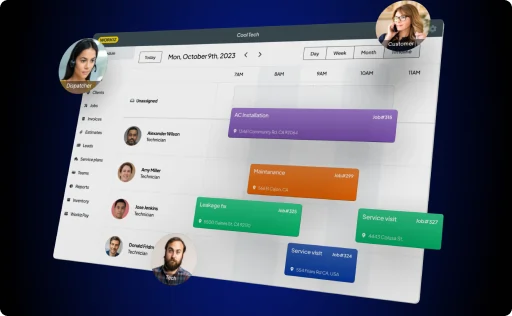

Automate field service management

Your business needs you now more than ever. Take off your schedule any redundant tasks that have nothing to do with helping it succeed. Workiz’s Automation Center can streamline leads and payment reminders for you, as well as send review requests on your behalf. This is how you can ensure no money or satisfied customer falls through the cracks while you’re busy keeping the business afloat.

Spend less time on the road

As gas prices aren’t expected to go down anytime soon, better drive as little as possible to ensure you don’t spend as much. Let Workiz set your techs’ schedules and driving routes. That’s how you’ll make sure they don’t travel great distances between one job to another or make unnecessary bypasses.

Offer financing options

Don’t fight clients asking you for a discount. Instead, help them out. Provide a sales proposal (including “good, better, best” options) to make sure every client can afford the job booked. Give them also a breather by offering a flexible payment plan using our integration with Sunbit.

Can inflation actually help your business grow?

Possibly. Remember how it was with Covid? Many service pros were hit hard by the pandemic and the crisis that followed, but the demand for their services increased as clients started spending more time indoors. Home improvement spending, for instance, jumped by 28% in 2021 from 2020 due to clients’ wanting to take better care of their homes, which also drove service rates to go up.

Similarly, inflation can be a boon for service businesses if they focus on home service and maintenance. As the cost of living increases, so does the need for regular upkeep and repairs around the house. And since people are becoming more comfortable letting service pros into their homes, now is the perfect time to focus on this growing market.

So how can you focus on growing in times like these? The answer lies in speed and agility.

Speed

To keep up with inflation, you need to be able to quickly adapt your prices and services. This means rapidly changing your pricing plans and service offerings on the fly. You also better be the first to answer the call, so even if the next pro inline offers a lower rate than yours, the client may still prefer you instead – because of your availability and determination.

How can you be the first to respond? Firstly, Use Workiz’s state-of-the-art Phone System that can take calls and messages during rush hours and off-hours. You can also enable Online Booking via your website to ensure you are the first to get booked while also offering non-service products in between. And that’s without mentioning Workiz’s integrations with Thumbtack and Angi, which save you time and money by syncing all these platforms simultaneously.

Agility

Flexibility will be key to success in the inflationary climate – you’ll need to be able to change your techs’ schedule by the minute, nurture every lead as the competition gets more brutal, and still be able to collect every payment you deserve, all while making sure the quality of the service provided is intact.

Field service work is never easy, especially during inflation, but using Workiz is. Every employee should have no problem using it to manage their jobs and clients. Meanwhile, Workiz can keep track of leads and revenue, allowing your team to focus on the work they were hired for.

Final thoughts

Inflation can be a daunting challenge for any business – but with the right tools and strategies, you can make it through and even grow faster than ever before.

As a startup that has grown tremendously since 2020, we know how it is to adapt and switch gears as market conditions change. Workiz is designed to help you manage your business more efficiently and adapt quickly to changes in the market. We offer a variety of features that help with scheduling and dispatch, invoicing and payments, and customer management, and we’re always adding new features and integrations to help you stay ahead of the curve.

So, if you’re looking for a way to streamline your business and get a leg up on the competition, give Workiz a try. We offer a free 7-day trial, so you can see how we can help you take your business to the next level. Alternatively, you can book a free demo to see how it works in real-time.