Cash: the declining king

The reality of the matter is “cash is declining”. While the descent isn’t plummeting, the trend is undeniable. We asked Jeff Eisenberg, director of Fintech monetization at Workiz what his thoughts are about cash and he highlighted how this shift gained momentum during the pandemic when fear of physical currency and a surge in online transactions revolutionized payment behaviors.

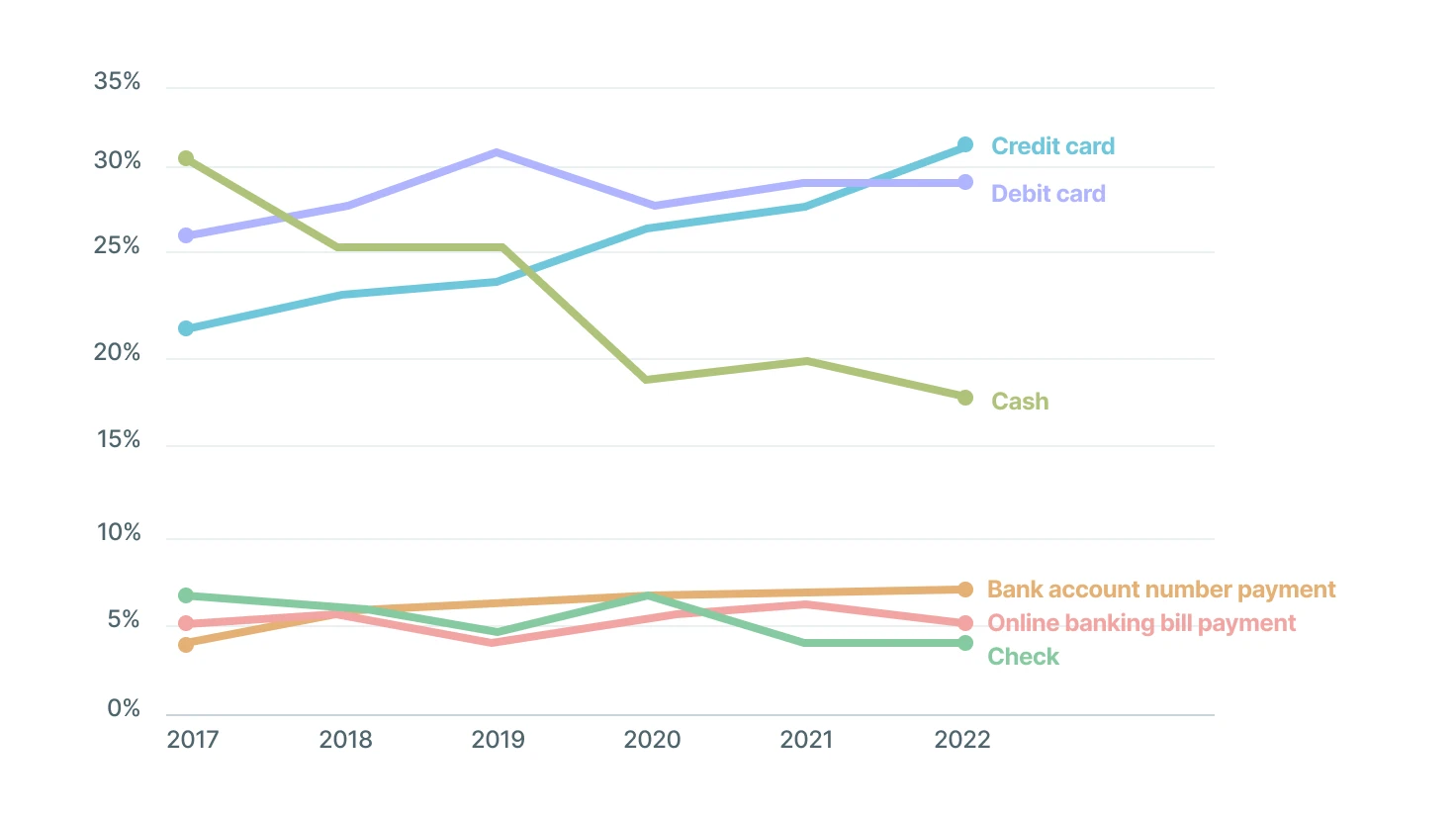

The data doesn’t lie. A staggering 10% decline in cash payments within field services illustrates a profound change. The reasons? When COVID-19 hit, the world was forced to use contactless payment solutions and credit cards. The perks of digital payments, from the added security, convenience, and increased customer service are reshaping consumer expectations.

Share of total numbers of payments

Source: Survey and diary of consumer payment choice

The digital wallet surge

Digital wallets have witnessed an extraordinary rise. With one in five consumers using platforms like Apple Pay or Google Pay monthly, convenience has become the consumer’s mantra. Significantly, these modern payment methods aren’t just about ease; they’re also about more spending. According to Katelyn Bean, Senior Account Executive of Fintech at Workiz, customers tend to spend 47% more using digital wallets, opening opportunities for upsells and more significant transaction values.

What influences consumers to use digital wallets?

Source: Forbes Advisor

Payment options beyond credit cards

Field service providers should offer a variety of payment methods, including credit cards, bank transfers, checks, and even cash apps. A lot of Workiz users take advantage of this by adding “optional add-on” upsells on estimates that customers can select through the client portal. This is an enormous opportunity for business owners to capitalize on since customers are 47% more likely to spend more on digital payments vs traditional payment methods.

The true cost of cash

Another highlight is the surprising revelation that cash, often perceived as a no-cost payment method, might be more expensive than assumed. When you include the operational expenses of moving cash from banking to accounting – estimates but the cost of taking cash at 4-15% of the cash value, that’s 2-5x the cost of most other digital payment types. Cash isn’t going anywhere immediately but there is a decline that the data supports.

“The operational overhead needed to collect, retrieve, deposit and ultimately reconcile cash payments takes you and your team’s away from what matters most – growing your customer base and delivering top notch service.”

Jeff Eisenberg, director of Fintech monetization

The holistic approach to payments

So, how do field service businesses prepare for the decline in cash payments? Workiz offers an integrated payment solution to streamline operations and increase the convenience for a better customer experience.

The exciting part is what lies ahead. Workiz is moving toward facilitating check deposits through apps, extending ACH payment options to commercial clients, and alternative financing options for continued innovation and support for their clients.

Take your business forward with Workiz

Payment trends will continue to evolve, but one thing is certain – businesses will always chase the holy grail of customer satisfaction and operational efficiency. As field service pros, make sure you’re equipped with the right tools to tackle trends head-on and keep your business flourishing.

Stay tuned for more Workiz webinars and updates that can help your business monetize the latest in fintech advancements, leaving the cash-only days in the past.

Are you ready to take the next step in optimizing your payment processes with Workiz? Reach out today and future-proof your business’s financial transactions.