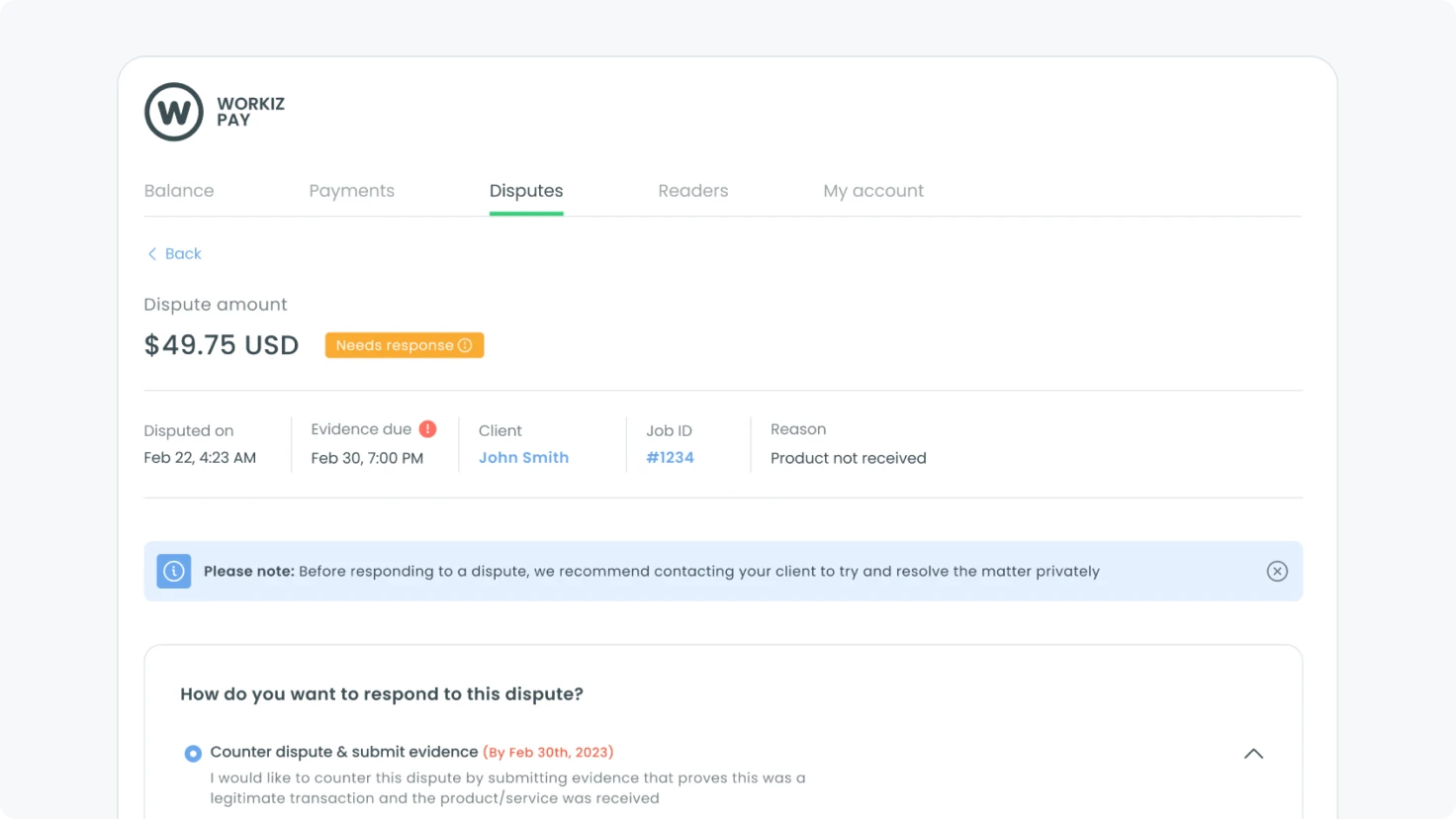

Thanks to Workiz, you’re prepared. Every detail of the job, including who worked that job, payment specifics, and all the back-and-forth emails with the client—everything is tracked. Plus, you’ve got photos of the finished job as solid proof. You bundle all these up for your defense.

The outcome? You pull off a win! This isn’t a stroke of wild luck—it’s the result of effective dispute management, something a lot of businesses tend to skip over. Intrigued to know more? Let’s get into the best practices in this blog post.

Understanding the landscape of disputes

First off, what is a dispute? A dispute is a disagreement or conflict between a customer and your business regarding a transaction. This usually happens when a customer challenges a charge on their bill, often citing reasons such as unauthorized charges, unsatisfactory services, or incorrect billing. Field services revolve around financial transactions—from service invoices to equipment purchases—that open up potential channels for disputes. Understanding what you will need to provide to win and avoid disputes is the first step towards proactive dispute management.

The high stakes of disputes

Disputes can significantly impact a business’s financial health and reputation. Poorly managed disputes can create ripple effects, tarnishing your brand image and limiting your ability to scale. It impacts cash flow management by tying up funds in question and requires time-consuming resolution efforts. In the event you receive too many disputes, credit card network monitoring systems can penalize you making it more difficult for your business to accept payments.

Best practices to avoid & fight disputes

The best way to reduce losses from disputes is to prevent them before they happen. Transparent and timely communication with your client on the job scope sets clear expectations that won’t be challenged. Getting that signature on an estimate and making sure you both have agreed to the price and terms of the job is absolutely crucial.

Signatures on all the upfront work agreements also protect you in the unfortunate event that an angry or dishonest customer disputes their payments. When your techs are on the job site, it’s highly recommended to take before, during and after pictures to clearly document the delivery of the service. When the job is done, immediately send an invoice. Take payment if possible with a card reader or tap to pay and get a signature on the paid invoice to avoid any misunderstandings in the future. All communications should be or recorded or via messaging so that no matter what you always have proof. Ultimately the banks who will be arbitrating the outcome of a dispute are looking to see that the customer agreed to and received the product or service they requested from you. Your careful documentation should provide the banks with detailed proof that you delivered your commitment and deserve the payment.

Finally, disputes must be addressed in a timely fashion. As soon as you receive notice of your dispute from your processing partner, reach out to the customer to enquire about what happened. The extra customer service touch may allow you to come to an amicable compromise and transform your customer into a satisfied one. If you are unable to work out an agreement, make sure you submit all your evidence before the due date. Once the deadline is missed, you forfeit your right to challenge the dispute.

Pro tip!

It’s important that you have a relevant Statement Descriptor, which is the way your business is identified on your customer’s credit card statement. A clearly identifiable name will give clarity to the cardholder about how they incurred the charge and will prevent them from mistakenly thinking it was an unauthorized transaction.

Technology: your trusted ally

Leveraging a software like Workiz that supports financial capabilities gives you one less thing to worry about when it comes to managing and winning disputes. Workiz helps you organize evidence and helps you fight for your hard earned money. You want a processor that has your back and provides you with the tools and the mechanisms to maximize your win rate.

“It’s super important to have a software in place because without the organization and the documented paper trail, you can potentially lose out on thousands of dollars. Without transparency, fighting and winning a case will be much more complicated and without instant access to your documents you will find yourself in a bit of a mess when trying to submit evidence and respond.”

Noa Burg, Risk Analyst at Workiz

Conclusion

Regardless of how often or how big these challenges are, being proactive about dispute management can really help you and your business from any dispute headaches. Keep those lines of communication open, stay on top of your paperwork, and have a software like Workiz that has everything all in one place. With these practices, you’re not just side-stepping any future mix-ups, but also building a solid reputation of trust and professionalism with your clients.