As medical experts point to social distancing as a vital tactic to combat the virus, extending the practice to payments will be essential to halting the spread of infection. This reality will hasten the shift towards an almost completely digital payment future. Simply put, the novel coronavirus should spell an end to the use of cash. And unlike the handshake, which is only on a temporary hold, soon cash could be gone altogether.

While the World Health Organization has stopped short of calling on people not to use banknotes – instead urging people to wash their hands after handling cash – ditching dollars for contactless payments is not only a smart precautionary measure amid the current coronavirus pandemic, but also represents a common-sense step for safeguarding the health of customers and merchants alike at all times.

Here’s why it’s high time to move away from cash – and how businesses can make the shift.

Dollar bills are germ havens

Well before the novel coronavirus reared its head, there was ample reason for people to be wary of banknotes.

To put it plainly, money is filthy. According to a 2017 study, US banknotes have a typical life span of 5 to 15 years of being passed between people. Furthermore, these bills contain hundreds of diverse microorganisms, including viruses, bacteria, pet DNA, and drug residue. What’s more, influenza cells can linger on paper notes for up to 17 days, researchers have found. And that’s to say nothing of the fecal matter and cocaine that’s made its way onto much of our cash.

New Coronavirus fears

Paper notes’ uncleanliness may hardly be news, but amidst the rapid spread of the coronavirus, it’s being seen in a new light.

The Louvre Museum in Paris has already stopped accepting cash payments in response to the virus’ spread to assuage employees’ anxiety, and analysts project that the “psychological factor” will drive more consumers to stay away from cash – and more businesses to turn to digital payment solutions like Apple Pay, PayPal, and Venmo.

In China, the origin of the coronavirus pandemic, the government ordered banks to disinfect paper notes, an order that’s been carried out using high temperatures and UV lights to disinfect bills. Moreover, their banks may only release sterilized bills.

Why businesses should stop using cash

Coronavirus has ushered in a strange new normal – one that’s likely to last for months, experts predict, with social distancing measures set to continue even after the outbreak reaches its peak. There are no pain-free solutions, but businesses that proceed as if all will be back to normal within a few short weeks are only guaranteeing themselves greater pain. Even as restrictions are lifted, public fear and anxiety are likely to persist for some time, with only a gradual return to normal activity.

In the payment realm, the time for a digital shift is now.

The benefits of a digital payment processor

In addition to helping employees and business owners stay germ-free and protect their health, digital payment processors offer a host of other benefits and are already being adopted by businesses looking to enhance their operations.

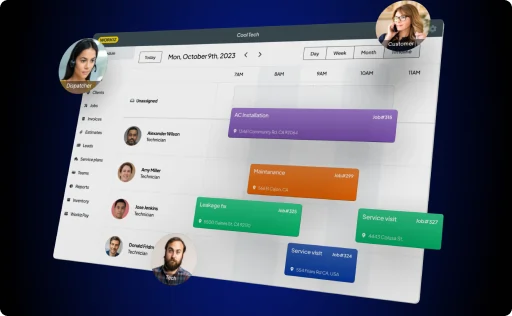

To ensure a smooth transition, businesses should try to find a payment processor that’s built into systems they already use.

For example, for businesses using a project management system, using a built-in payment processor will help streamline activities, automatically update client records, and include all payment information within a system that’s already native to a specific business. This creates a paper trail and enables them to keep excellent, comprehensive payment records.

It also helps them save time, as all payment data is in one centralized system – preventing double entry and saving employee labor hours.

A post-cash society

Long before the current crisis, it was clear that cash was on its way out.

Let’s let cash go quietly into the night and leave it squarely in the pages of history, where it best belongs.

Our health – and the survival of our businesses – may very well depend upon it.